In her tax-raising Budget on 26 November 2025, the Chancellor announced that the dividend ordinary...

News & Insights

Read the latest insights from our experts

Explore more

During the Chancellor’s Budget speech, savers received the unwelcome news that the rate of tax on...

13 Jan 2026

The £100,000 cliff edge

All things being equal, receiving a pay rise which takes your income over £100,000 would be seen as...

8 Jan 2026

Are you exempt from MTD for ITSA?

Making Tax Digital for Income Tax Self Assessment (MTD for ITSA) is mandatory from 6 April 2026 for...

4 Jan 2026

Correcting errors in VAT returns

It used to be possible to report errors in a VAT return to HMRC on form VAT652. This is no longer...

27 Nov 2025

📰 Budget: November 2025

On 26 November 2025, Chancellor Rachel Reeves presented her second Budget to Parliament. After the...

25 Nov 2025

Do you have an unclaimed Child Trust Fund?

A press release recently published by HMRC revealed that 758,000 young people between the ages of...

The normal filing deadline for the 2024/25 Self Assessment tax return is 31 January 2026. However,...

17 Nov 2025

What counts as a ‘reasonable excuse’?

A taxpayer may have grounds for appealing a penalty if they have a reasonable excuse for missing a...

The UK is preparing for a highly anticipated Budget next week, where the Chancellor, Rachel Reeves,...

Big changes are coming to Companies House from Spring 2026, aimed at increasing transparency and...

22 Sep 2025

Taxation of savings income in 2025/26

There are various ways to enjoy savings income without paying tax on it. In addition to the...

Making Tax Digital for Income Tax Self Assessment (MTD for ITSA) is introduced progressively from 6...

7 Aug 2025

Extension to MTD for ITSA

Making Tax Digital for Income Tax Self Assessment (MTD for ITSA) is introduced progressively from 6...

10 benefits of filing your 2024/25 tax return early As the 2024/25 tax year has now come to an end,...

Tax deadlines, whether for self-assessment, VAT, PAYE, or Corporation Tax, can create significant...

1 Jul 2025

Payments on Account - due soon!

The deadline by which to pay your second payment on account for your self assessment tax return is...

24 Jun 2025

New thresholds for off-payroll working

The off-payroll working rules apply where a worker provides their services to a medium or large...

Let’s be honest, running a business is already full-on. The last thing you need is the added stress...

As a small business owner, you're constantly looking for ways to streamline operations, get paid...

18 Jun 2025

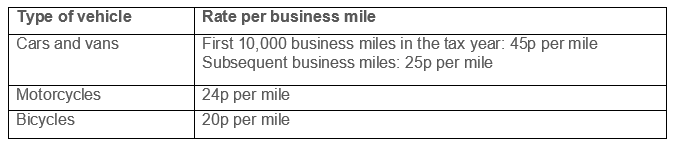

Claiming mileage relief

Employees may pay for the fuel that they use for business journeys undertaken in their own car or...

5 Jun 2025

Incorporating your property business

Running a property business through a limited company has become increasingly popular, not least...

We know that securing a mortgage can sometimes feel overwhelming—especially if you're...

13 May 2025

Claiming mileage relief

Claiming mileage relief Employees may pay for the fuel that they use for business journeys...

24 Apr 2025

Claim a refund if you have overpaid tax

There are various reasons why tax may be overpaid, and when more tax has been paid than is due, it...

17 Apr 2025

Starting a business as a sole trader

When starting a business, there are various decisions to make and tasks to perform. One of the...

With recent increases in National Insurance (NI) contributions, salary sacrifice schemes have...

For many years the most tax-efficient method of withdrawing monies from a company by a sole...

10 Apr 2025

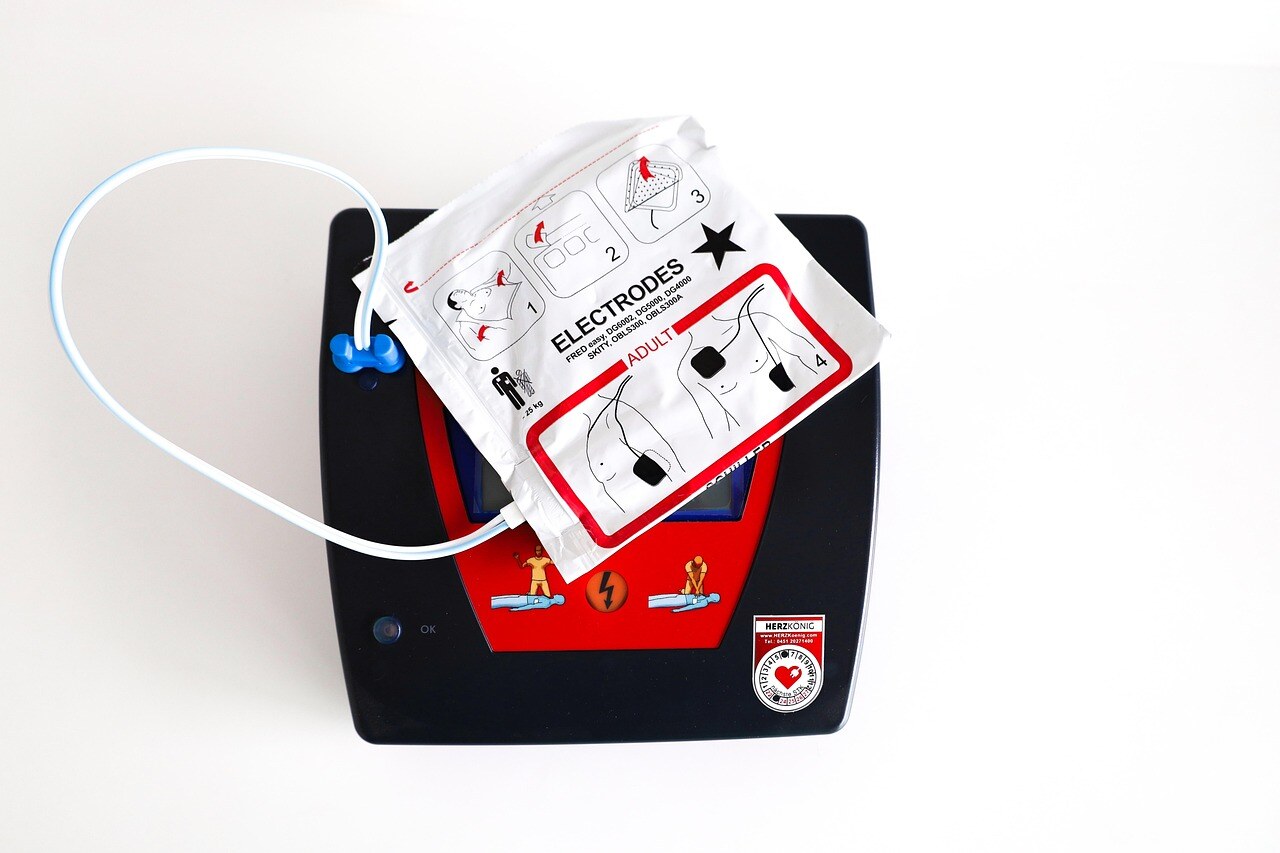

Local charity provides free first aid courses

Would you know what to do if someone collapsed from cardiac arrest in front of you? Keen to...

4 Apr 2025

What is VAT flat rate scheme?

The VAT flat rate scheme is a simplified flat rate scheme which can be used by smaller businesses...

27 Mar 2025

Spring Budget 2025 - no significant tax changes

Chancellor Rachel Reeves' Spring Statement of March 26, 2025, addressed the UK's economic...

27 Mar 2025

Boost Your Pension and Reduce Corporation Tax

Running your own business comes with plenty of perks, but did you know that paying pensions through...

In short, a P11D form allows you to inform HMRC of any benefits you’ve given to employees outside...

Benefits in kind (BIK) are goods and services provided to an employee (or a member of their family...

13 Mar 2025

Using the VAT flat rate scheme

The VAT flat rate scheme is a simplified flat rate scheme which can be used by smaller businesses...

At Inform Accounting, we believe in giving back to the community and supporting causes that make a...

If you are self-employed, you will pay tax on your taxable profit. In working out your taxable...

28 Feb 2025

Invest tax efficiently

Tax efficient investment comes with varying risk profiles, from high to low. We look at both ends...

High Income Child Benefit Charge Income thresholds for the High Income Child Benefit Charge (HICBC)...

20 Feb 2025

Plan for tax efficient business motoring

Planning for the cost of business motoring is always important. We look here at the change to the...

17 Feb 2025

Dealing with directors’ loan accounts

What are directors’ loan accounts? It is common for director-shareholders in family companies to...

13 Feb 2025

Managing new employer National Insurance rules

Autumn Budget 2024 announced sweeping changes to the National Insurance regime for employers from 6...

12 Feb 2025

Is it worth paying voluntary Class 3 NICs?

The payment of National Insurance contributions is linked to entitlement to the state pension. If...

24 Jan 2025

12 Accounting Tips this Christmas

As the holiday season approaches, businesses are not just decking the halls - they’re also closing...

If you are self-employed, you will pay tax on your taxable profit. In working out your taxable...

The Annual Investment Allowance (AIA) is a valuable tax incentive in the UK designed to encourage...

1 Nov 2024

Budget to increase taxes by £40bn

After a damning verdict on the inheritance of the public finances from the previous conservative...

1 Nov 2024

Be careful - Winter Fuel Payment scam

We have been made aware of the start of criminal activity using both text messages and emails to...

22 Oct 2024

What will the Budget bring?

With the Budget coming on 30th October, speculation is increasing on what changes will be...

Electric cars are increasingly popular, not just for their environmental benefits, but also for...

One of the most pressing topics in UK business and accounting is the anticipated tax rises in the...

As National Payroll Week rolls around, it’s time to pause and celebrate the incredible work of our...

28 Aug 2024

Telling HMRC you have no Corporation Tax to pay

If you have a company that is dormant and you have filed your company tax return showing that no...

The tax legislation contains a number of exemptions which allow benefits in kind to be provided to...

28 Aug 2024

Budgeting for New Hires: A Step-by-Step Guide

Are you gearing up to bring new talent on board? Don't let the complexity of budgeting for new...

Invoicing is a critical part of running any business, but it’s also one of the most tedious. The...

24 Jun 2024

Understanding your tax code

Tax codes are fundamental to the operation of PAYE. If your tax code is correct, you should pay the...

29 May 2024

Navigating HMRC Scam Letters: How to Spot a Fake

In today's digital world, fraudulent schemes - particularly those involving HMRC scams - are on the...

It is often said that inheritance tax (IHT) is a voluntary tax, and one that can be avoided if you...

30 Apr 2024

Check your National Insurance record

Paying National Insurance contributions allows individuals to earn qualifying years, which in turn...

25 Apr 2024

Selling online – When do you need to tell HMRC?

Earlier in the year, it was erroneously reported in the press that new tax rules were coming into...

Diving into self-employment and starting your own business is by no means an easy feat. With that...

HMRC are sending one-to-many ‘nudge’ letters to taxpayers who included an invalid claim for gift...

27 Feb 2024

Year End Tax Planning Guide

With the closure of the 2023 tax year approaching on April 5, 2024, there remains an opportunity to...

The High-Income Child Benefit Charge (HICBC) is a tax charge that claws back child benefit where...

8 Feb 2024

Voluntary disclosure

Voluntary disclosure involves individuals or businesses coming forward to inform HMRC of any errors...

6 Feb 2024

Tax and Influencers

Earlier this year, HMRC sent ‘nudge’ letters to social influencers who they suspect may not have...

While the economy may be slowly moving in the right direction, we´re not out of the woods yet! So,...

29 Jan 2024

Registering with the Tax Authorities

A significant task for the new business owner is ensuring that the business is properly complying...

Owners of personal and family companies frequently pay themselves a small salary and extract...

What do you really want from the New Year? As the calendar turns to 2024, we are all contemplating...

18 Jan 2024

Relief for post-cessation expenses

The end of a business will not necessarily mean that no further expenses are incurred. Where...

Main residence relief is a valuable relief which prevents a tax charge arising where a gain is...

Satago solutions are designed to facilitate intuitive, data-driven decision-making while ensuring...

9 Jan 2024

The implications of late VAT registration

VAT registration is compulsory for any UK established persons who are in business and make or...

We have joined Chaser’s Partner Programme to help SMEs get paid faster with market-leading credit...

Ready to turn your brand vision into a vibrant commerce experience? Look no further than Shopify –...

Starting a business from scratch or eyeing a new commerce partner? The options might be...

4 Jan 2024

Unlocking eCommerce Excellence: A Comprehensive Guide to Shopify's Features and Functionality

Every day, countless individuals, whether selling online, in physical stores, or across...

Ever started a new job and felt like you've been thrown into the deep end? It's unsettling, to say...

28 Nov 2023

Reporting residential property gains

If you make a chargeable gain on the sale of a UK residential property, you will need to report the...

23 Nov 2023

Simplified sales accounting with Dext Commerce

Designed with bookkeepers, accountants, and businesses in mind, Dext Commerce's accounting...

Puzzling over whether that quick lunch or client dinner can be claimed on your tax return? If so,...

'Tis the season for spreading cheer, and what better way for employers to do so than by gifting...

Today, the Chancellor of the Exchequer, Jeremy Hunt, announced his measures (a whopping 110 of...

Your safety and security is of utmost importance to all of us at Inform Accounting. In this age of...

20 Nov 2023

Wise - Money without borders

We're proud to be partnered with one of the market-leading foreign currency accounts! Wise Business...

Inform Accounting are proud to partner with Soldo, a specialist business spend management platform.

Inform Accounting are proud to partner with iwoca, a specialist small business lender who have...

9 Nov 2023

Business Loans - simplified with IWOCA

Inform Accounting are proud to partner with iwoca, a specialist small business lender who have...

9 Nov 2023

Funding support from Funding Circle

We’re proud to partner with Funding Circle to provide a funding solution for our clients. We know...

31 Oct 2023

Self-serve Time to Pay for VAT

For some time, taxpayers within Self Assessment have been able to set up a Time to Pay arrangement...

31 Oct 2023

Dext Prepare - Business finances, made easy

You’re in business to do business, not paperwork. Dext is the business expense tracker that tracks,...

26 Oct 2023

Claiming overlap relief

If you are self-employed, the way in which your profits are taxed is changing. As a result of this,...

Private residence relief means that you do not have to pay capital gains tax on any gain that you...

19 Oct 2023

10 deductible expenses

If you let out a property, you can deduct the business expenses that you incur when working out...

17 Oct 2023

Do we need to register the business for VAT?

If you make VATable supplies, you will need to register for VAT if your taxable turnover reaches...

13 Oct 2023

Should I file my tax return early?

If you need to file a Self Assessment tax return for 2022/23, you have until midnight on 31 January...

Ever found yourself lying awake at night, wondering how to keep more of your hard-earned revenue...

3 Oct 2023

How to appeal a tax penalty

There are various reasons why HMRC may issue a tax penalty. You may receive a penalty if you file...

29 Sep 2023

Autumn Statement date set for 22 November

The Treasury has announced that the Office of Budget Responsibility (OBR) will produce a report on...

HMRC is clamping down on the use of high-volume addresses by online sellers to disguise their...

HMRC have sent out nudge letters to taxpayers who they believe may have claimed Business Asset...

Wouldn’t life be simple if you could guarantee that your invoice would get paid on time, every...

Millions of employees will be able to request flexible working from day one of their employment,...

The Department for Work and Pensions (DWP) has announced more detail on the payment schedule for...

29 Aug 2023

Minimum wage rates increase from 1 April 2023

Employers should be aware that all minimum wage rates increase on 1 April of each year. This...

15 Aug 2023

Unincorporated businesses overlap relief

From 6 April 2024, all unincorporated businesses will be taxed on their profit or loss arising in...

14 Aug 2023

Introducing our partner business, Neate & Pugh

Neate & Pugh are a niche employment law and HR solutions firm, set up by Ann-Marie Pugh and Emma...

14 Aug 2023

Modulr - taking the pain out of manual payments

We wanted to tell you about our new payment service that is taking away the manual headache of...

8 Aug 2023

HOW creative agencies can make more profit

Managing Director, Sian Kelly, of Inform Accounting shares what businesses in the creative...

7 Aug 2023

Beware Bogus HMRC Phishing Scams

HMRC is aware of a phishing campaign telling customers they can claim for the fourth...

Claims for the fourth Self Employed Income Support Scheme (SEISS) can now be made and must be...

27 Jun 2023

Beware the new VAT late submission penalties

A new penalty regime was introduced for VAT from 1 January 2023. The new regime comprises late...

19 Apr 2023

Managing inheritance tax

Like many other taxes, inheritance tax (or IHT) allowances have been frozen. This sounds generous...

There are costs to running a business, and whilst electricity, gas and water seem like obvious...

11 Apr 2023

Rates and thresholds for employers 2023 to 2024

Employers should be aware that from April 2023 several statutory payment rates increase for the...

The Energy Bills Discount Scheme runs for 12 months from 1 April 2023 to 31 March 2024.

The Bank of England Monetary Policy Committee announced on 23 March 2023 to increase the Bank of...

Last week, the Foreign Secretary, James Cleverly, and Vice President to the European Commission,...

Silicon Valley Bank (UK) Ltd (SVB UK) was sold last week to HSBC for a symbolic £1. HSBC,...

21 Mar 2023

Tax Rates & Reliefs

On 15 March 2023, Chancellor Jeremy Hunt presented his first Budget to Parliament and set out a...

15 Mar 2023

Chancellor's Spring Budget 2023

The Chancellor announced his March budget today. Similar to the budgets, autumn statements and...

13 Mar 2023

What can we expect from the Budget on Wednesday?

Chancellor Jeremy Hunt has made it clear that he does not have room for big tax giveaways on March...

7 Mar 2023

New VAT penalties and interest payments

The new penalties will impact businesses who submit their VAT returns or pay their VAT late. The...

If you are planning to claim the UK state pension you should check your national insurance (NI)...

The Public and Commercial Service (PCS) union has announced Civil Service industrial action that...

23 Jan 2023

Statutory Pay Rates from April 2023

The UK Government has published the proposed statutory rates for maternity pay, paternity pay,...

23 Jan 2023

Ban on single-use plastics in England

A range of polluting single-use plastics will be banned in England, Environment Secretary Thérèse...

The Government has announced a new Energy Bills Discount Scheme (EBDS) from April 2023 to April...

12 Jan 2023

Receive and make payments faster with Crezco

We’re really excited to be partnering with an award-winning payment solution, Crezco. Winner of...

10 Jan 2023

Filling historic gaps in National Insurance (NI) records comes to an end on 5 April 2023

The ability to fill historic gaps in National Insurance (NI) records to top up your state pension...

9 Jan 2023

Government extends Mortgage Guarantee Scheme

The Mortgage Guarantee Scheme will be extended by a year to the end of December 2023, helping...

The mandatory use of software for Making Tax Digital for Income Tax Self-Assessment is being phased...

4 Jan 2023

A Guide to VAT on Commercial Properties

Understanding VAT rules can be complicated at the best of times, so it’s no surprise that there’s...

12 Dec 2022

Tax Free Christmas Gifts To Staff

This is a timely reminder that employers may make small tax-free gifts to employees and directors...

HMRC is reminding taxpayers that they must declare COVID-19 payments in their tax return for the...

28 Nov 2022

“Off-payroll” working rules continue to apply

With all of the U-turns on tax policy in the last couple of months, businesses may be confused...

For VAT periods starting on or after 1 January 2023, HMRC is replacing the default surcharge with...

24 Nov 2022

Old-style stamps will soon be out of date

Royal Mail are adding barcodes to their regular stamps. After 31 January 2023, regular stamps...

18 Nov 2022

Chancellor's Autumn Statement...

The Chancellor announced his Autumn Statement yesterday. We already knew that he was going to raise...

14 Nov 2022

What to expect on Thursday....

Jeremy Hunt is scheduled to deliver his first Autumn Statement on Thursday (17 November). Reports...

14 Nov 2022

Own a Buy to Let? Then read on...

If you own a property which is let out, HMRC may contact you with a "nudge letter'', if they...

We all have to pay taxes. But what if we told you there are several strategies you can adopt to...

Today yet more changes and reversals to the Kwarteng mini-budget that wasn’t a budget. In short,...

20 Sep 2022

New beginnings in uncertain times

The 70-year reign of Queen Elizabeth II was marked by her sense of duty and her determination to...

If you use Royal Mail to deliver your goods, you should be aware of the planned industrial action...

If you own property there are a number of tax implications which you need to be aware of.

HMRC has published the latest advisory fuel rates (AFR) for company car users, effective from 1...

New just in - the Bank of England has announced the largest increase in interest rates in 25 years,...

The Covid-19 pandemic forced large numbers of employees to work from home for the first time....

25 Jul 2022

Tax-efficient finance for your company

HMRC have recently updated their guidance for companies looking to attract investors to buy shares...

Unincorporated businesses and companies planning capital expenditure projects need to be aware of...

The talent shortage continues to place a burden on the economy. As companies struggle to find the...

30 Jun 2022

Should I change my accounting date?

In preparation of the introduction of MTD for income tax, which comes into effect from 6 April 2024...

28 Jun 2022

Deferring capital gains tax on a business asset

The potential to be charged capital gains tax (CGT) arises with the sale or gift of an asset....

28 Jun 2022

Preserving the personal allowance

The personal allowance is set at £12,570 for 2023/24. However, not everyone is able to benefit from...

28 Jun 2022

Customer case study: Haig & Co

Haig & Co is an accountancy and finance recruitment firm based in Birmingham founded almost six...

28 Jun 2022

Making payroll work for you

One of the worries we often hear from businesses looking to outsource their payroll to an...

28 Jun 2022

COVID-19 economic support packages

The government announced in late December additional economic support to help businesses who have...

The main residence exemption applies for capital gains tax purposes to the extent that a property...

28 Jun 2022

What is the best use of your time in January?

We encourage all clients to consider taking time to prepare a 2022 Strategic plan. “A sailor...

28 Jun 2022

Customer case study: eCommerce Retail

In 2018, a relatively small (but growing) ecommerce business approached Inform Accounting, after...

On Friday afternoon the UK Prime Minister, Liz Truss held a press conference. Ahead of this press...

Class 2 NICs are flat-rate contributions payable by the self-employed, currently charged at a rate...

Tax payments for the self-employed or those who declare their income under self-assessment are...

If you have a spare room in your home, you may consider letting it out to raise some much-needed...

28 Jun 2022

Giving away money free of IHT

Most people do not want to give money to the taxman when they die. However, while it is said that...

The Accounting Excellence Awards 2020 are targeted at recognising the ‘highs’ in the accounting and...

Following the increase in the Bank of England base rate to 1.25% earlier this week, HMRC has...

If you’ve made an R&D claim and are wondering where the payment is, HMRC has recently released this...

HMRC have issued guidance for VAT-registered businesses and their agents on how to avoid penalties...

31 May 2022

Advisory fuel rate for company cars

Unbelievably there were very few changes to the HMRC advisory fuel rates from 1 March 2022, which...

24 May 2022

New internet phishing alert!

New emails and letters appearing to be from employees of the Government Legal Department / Bona...

24 May 2022

The Recovery Loan Scheme is ending soon

The Recovery Loan Scheme supports access to finance for UK businesses as they grow and recover from...

The Annual Tax on Enveloped Dwellings (ATED) is a tax on high-value residential properties that are...

The nature of a gift is that it is something that is given without receiving a payment in return....

28 Apr 2022

Relief for rental losses

While the intention is to make a profit from letting out a property, this is not a given, and a...

In a personal or family company the director will often borrow money from the company. This can be...

The age-old question for many directors is whether they should take a salary, dividends, or both....

26 Apr 2022

VAT flat rate scheme – is it worthwhile?

The VAT is a simplified scheme that can save work. Instead of working out the VAT that you need to...

Where a property is let out, there are likely to be periods when the property is empty, either...

Director’s loans, under the right circumstances, can help in the planning of withdrawing funds from...

Tax policy is used to influence behaviour as well as to collect revenue. One example where this is...

29 Mar 2022

Should you pay a dividend before 6 April 2022?

If you operate your business through a personal or family company and extract profits in the form...

If you realise a chargeable gain on a UK residential property, you now have 60 days rather than 30...

24 Mar 2022

The Ups and Downs of the Spring Statement 2022

The Chancellor of the Exchequer, Rishi Sunak, delivered his Spring Statement on Wednesday 23 March...

17 Mar 2022

Using your annual exempt amount for 2021/22

All individuals are entitled to an annual exempt amount for capital gains tax purposes. Net gains...

14 Mar 2022

Tax relief for pre-trading expenses

There is a lot of preparation involved in setting up a business, and costs will be incurred, which...

You've probably heard the phrase Making Tax Digital (MTD) for VAT thrown around a lot over recent...

Transactions between a director and his or her personal or family company are common and a...

8 Mar 2022

Dividend 'traps'

A shareholder/ director is permitted to withdraw monies from the company’s bank account as salary,...

As we approach April 2022, a number of changes announced in the Chancellor’s latest Budget come...

To help meet the costs of health and adult social care, a new levy, the Health and Social Care...

3 Mar 2022

New advisory fuel rates published by HMRC

New advisory fuel rates for company car drivers have been published by HMRC, which are to be...

3 Mar 2022

New advisory fuel rates published by HMRC

New advisory fuel rates for company car drivers have been published by HMRC, which are to be...

As many of our clients know, and if it isn't clear enough on from our website, we LOVE Xero cloud...

16 Feb 2022

Tax Rates and Allowances - 2022/23

Sometimes it can be difficult to find the most recent tax rates for any given type of tax. We've...

As part of the Government’s push to encourage drivers to ‘go electric’, the Transport Secretary,...

Where a chargeable gain arises in respect of a UK residential property, since April 2020, the gain...

Under the current rules for determining which profits of an unincorporated business are taxed in a...

10 Jan 2022

Income from savings – What is tax-free

Not all types of income are equal from a tax perspective, and savings income enjoys dedicated...

The self-assessment tax return for 2020/21 must be filed online by midnight on 31 January 2022 if a...

7 Jan 2022

Struggling to pay tax – What should you do?

The January self-assessment payment deadline is not well timed, falling as it does in a month when...

HM Revenue and Customs (HMRC) is reminding Self-Assessment tax payers to declare any COVID-19 grant...

4 Jan 2022

Taxing cryptoassets: what you need to know

With crytocurrencies and other cryptoassets becoming more prevalent in the digital financial world,...

5 Nov 2021

HMRC say ‘play or repay’ on SEISS grants

HMRC are currently writing to taxpayers who made a claim for one of the first three COVID-19 Self...

5 Nov 2021

Registering your trust with HMRC

It is now a requirement that all UK trusts, whether taxable or non-taxable, must be registered with...

Over the last year we’ve learnt that corporation tax will increase in 2023, and that there will be...

The HMRC guidance has been recently updated to reflect the fact that employees can no longer be...

HM Revenue & Customs (HMRC) has confirmed that their new points-based penalty regime will come into...

The announcements by the Prime Minister of a 1.25% rise in National Insurance Contributions (NICs)...

Talking about money is never easy, especially when you’re a small business owner. But,...

1 Sep 2021

Help to Grow: Digital

Help to Grow: Digital is a new UK-wide scheme to help small and medium size businesses (SMEs) adopt...

As the result of recent increases in petrol and diesel prices HMRC have increased the advisory fuel...

Open until 31 March 2021, the Governments' Bounce Back Loan Scheme (BBLS) helped support businesses...

23 Aug 2021

New furnished holiday lets – Applying the test

All business must start at some point, and a furnished holiday lettings (FHLs) business is no...

If you sell a property that has not been your main residence throughout the period that you have...

20 Aug 2021

'Thank you all very much' - Cazper's Hair Studio

With everything that has been happening in the world over the last few months, and the shadow of...

17 Aug 2021

Making mileage payments to employees

As the country emerges from the Covid-19 pandemic, business travel is once again on the agenda....

Tax relief is available to encourage individuals to make contributions to registered private...

4 Aug 2021

Collection of tax debts post Covid-19

During the Covid-19 pandemic, HMRC paused much of their tax collection work, both to allow...

HMRC has confirmed that the applications platform for the fifth grant for Self Employment Income...

2 Aug 2021

RTI penalties and period of grace

Under real time information (RTI), employers are required to report pay and deductions information...

29 Jul 2021

Unrelieved interest on residential lets

For 2020/21 and later tax years, unincorporated property businesses are only able to obtain relief...

26 Jul 2021

Income taxes might be changing… keep in the know

On 20 July 2021, the Treasury and HMRC issued a number of policy papers and consultations flagging...

23 Jul 2021

New lower SDLT residential threshold

Back in July 2020, the residential stamp duty land tax threshold in England and Northern Ireland...

22 Jul 2021

Relief for losses in the early years of a trade

It is not uncommon to realise a loss in the early years of a trade. However, traders who commenced...

21 Jul 2021

350 Miles In Your Shoes

The phrase ‘to walk a mile in someone else's shoes’ is often used as a passing idiom, a neat and...

With the fifth in the series just days away, the Self-Employed Income Support Scheme (SEISS) seems...

19 Jul 2021

Tax relief on loans to close companies

Family and personal companies are often ‘close’ companies. Broadly, this is one that is controlled...

16 Jul 2021

HMRC to announce 5th SEISS grant

A fifth SEISS grant was announced in the Budget on 3 March 2021, and will be made available over...

As the Coronavirus Job Retention Scheme comes to an end, employers with employees who are still on...

13 Jul 2021

The sole trader, VAT and when to incorporate

Are you a sole trader? Thinking about switching to a limited company? What about VAT registration?...

During the Covid-19 pandemic, the advice was ‘work from home if you can’. As a result, millions of...

8 Jul 2021

Take dividends while you can

For personal and family companies, a tax efficient strategy for extracting profits is to take a...

5 Jul 2021

SDLT Multiple Dwellings relief

Multiple dwellings relief’ (MDR) allows a rate to be charged at the percentage payable on the...

1 Jul 2021

Tax consequences of 'illegal' dividends

Dividends can only be declared out of a company’s available undistributed profits, and if the...

30 Jun 2021

Dividend waivers

Dividends are paid at the same rate for each category of share according to the number of shares...

HMRC has the power to enquire into any return and request any information to establish whether that...

Running a property business through a limited company rather than as an unincorporated business may...

22 Jun 2021

Furnished Holiday Lettings

Furnished holiday lettings offer a number of tax advantages over longer lets. One of the key...

21 Jun 2021

Case Study: Strategy Plus

Every small business understands the importance of having the right financial information at the...

21 Jun 2021

NIC and company directors

Special rules apply to company directors when it comes to calculating their Class 1 National...

16 Jun 2021

Amend your PSA for Covid-19 related benefits

A PAYE Settlement Agreement (PSA) enables an employer to meet the tax on certain benefits and...

If you operate through a limited company, for example as a personal or family company, you will...

14 Jun 2021

US Sales Tax Filing for eCommerce Sellers

Are you an eCommerce seller with retail sales in the US? Chances are you’re thinking about indirect...

14 Jun 2021

Penalties for late forms P11D

It’s that time of year again when P11D’s are due to be submitted by 6 July for each employee you’ve...

10 Jun 2021

Expenses and benefit returns for 2020/21

Expenses and benefits returns P11D and P11D(b) for 2020/21 need to be filed by 6 July 2021. Meeting...

Most landlords will need some sort of finance in order to invest in property to let out. However,...

From financial benefits to planning benefits, there are countless reasons why you should want your...

For capital gains tax purposes, there is a tax-free uplift to the market value at the date of...

The Employment Allowance is a National Insurance allowance that enables eligible employers to...

1 Jun 2021

Directors' Loan Accounts

A 'Directors Loan Account' (DLA) is an account in the company’s financial books that records all...

31 May 2021

The MTD Timeline - know your responsibilities

Making Tax Digital, or ‘MTD’ for short, is an initiative taken by HMRC to digitise the tax...

28 May 2021

Freezing of allowances and thresholds

To help meet some of the costs incurred in dealing with the Covid-19 pandemic, the Chancellor...

27 May 2021

Distributions on company cessations

On cessation many directors find that monies have accumulated over the years which need to be...

25 May 2021

Reporting expenses and benefits for 2020/21

Employers who provided taxable expenses and benefits to employees during the 2020/21 tax year will...

21 May 2021

Reduced rate of VAT

To help the hospitality and leisure industry recover from the impact of the first national...

19 May 2021

Buy-to-let or furnished holiday letting?

When looking for an investment property, there are various decisions that need to be made. If the...

17 May 2021

Restart Grants and Recovery Loans

As lockdown restrictions are eased, businesses may need help to re-open and to recover from the...

Despite successive Governments changing the rules to increase the tax take, the provision of...

12 May 2021

CIS compliance for property developers

The Construction Industry Scheme (CIS) is a scheme whereby contractors of building firms are...

11 May 2021

Shareholder agreements

For limited companies, when it comes to making decisions, Company Law states shareholders who own...

Claims for the fourth Self Employed Income Support Scheme (SEISS) can now be made and must be...

The residence nil rate band (RNRB) is an additional nil rate band that is available for inheritance...

6 May 2021

Beware Bogus HMRC Phishing Scams

HMRC is aware of a phishing campaign telling customers they can claim for the fourth...

Stamp Duty Land Tax (SDLT) is payable where property is acquired in England and Northern Ireland....

30 Apr 2021

Tax Allowances Frozen till April 2026

The financial impact of the Covid-19 pandemic is unprecedented and borrowing levels in 2020/21 of...

27 Apr 2021

Further Grants for Self- Employed

The Self-Employment Income Support Scheme (SEISS) has provided grant support for self-employed...

23 Apr 2021

Landlords buying a second home - know your taxes

All homeowners are subject to Stamp Duty Land Tax (SDLT), as well as potential Capital Gains Tax...

Many businesses have suffered losses as a result of the Covid-19 pandemic, and where a business has...

A popular profit extraction strategy for shareholders in personal and family companies is to pay a...

12 Apr 2021

Restart and Recovery

In his Spring Budget 2021, Chancellor Rishi Sunak announced two new funding opportunities for...

As a landlord, the lower the taxable profit from your property rental business, the less tax you...

Unlike a gain on the sale of a main residence, which qualifies for private residence relief (as...

In light of the outbreak of the pandemic in late March last year, HMRC announced an extension to...

As the 2020/21 tax year draws to a close, many employees will have spent much if not all of the...

18 Mar 2021

National Insurance Contributions for 2021/22

The 2020/21 tax year starts on 6 April 2021. From that date, new thresholds apply for National...

Business interruption insurance provides cover for losses as a result of events that close or...

What to do from 6 April 2021 if you provide services through an intermediary Prior to 6 April 2021,...

4 Mar 2021

Spring Budget 2021

In his speech yesterday, Chancellor Rishi Sunak talked of recovery and building our future economy....

In July last year, the Government announced a temporary increase in the residential stamp duty land...

The benefits to selecting the right accountant If you’ve been a relatively small business making...

19 Feb 2021

Statutory payments from April 2021

By law, there are various statutory payments that an employer must make to an employee while the...

18 Feb 2021

Customer case study: Happy Self Journal

"The appeal to us was their knowledge of e-commerce, and also the fact that they offered us the...

17 Feb 2021

Deferred VAT portal to open 23 February

The portal for businesses to apply to spread their deferred VAT last summer is due to open on 23...

16 Feb 2021

Legal v illegal dividends

Changed business conditions in light of the Coronavirus pandemic have caused many companies to...

Pay As You Grow options, which allow borrowers to tailor repayments to suit their circumstances,...

11 Feb 2021

Renovating the holiday let during lockdown

The Covid-19 pandemic has hit the hospitality and leisure industry hard. Landlords with furnished...

If you’ve put employees on furlough during the pandemic, they’ll likely have a large amount of...

All taxpayers, regardless of the rate at which they pay tax, are entitled to a tax-free allowance...

5 Feb 2021

Electric cars from April 2021

For 2020/21, it was possible to enjoy an electric company car as a tax-free benefit. While this...

You may have heard of VAT domestic reverse charge (DRC) for the construction industry, which is new...

3 Feb 2021

Time to Pay Arrangements with HMRC

As part of the Chancellor's Coronavirus support package taxpayers were permitted to defer payment...

Still coming down from the high of a double win for Client Service and Digital Accounting Firm of...

R&D tax credits can be a valuable support mechanism for many SME’s, providing financial support to...

The guidance on how to pay VAT payments deferred between 20 March and 30 June 2020 has been updated...

Self assessment taxpayers will not receive a penalty for their late online tax return if they file...

25 Jan 2021

New HMRC scam targeted at taxpayers

A new scam is being reported, targeted specifically at taxpayers seeking to pay their tax due 31...

22 Jan 2021

Reclaiming SSP for periods of self-isolation

The Coronavirus Statutory Sick Pay Rebate Scheme allows smaller employers to reclaim some or all of...

21 Jan 2021

How to handle HMRC time to pay rejections

Some taxpayers and advisers using the online service to defer tax due on 31 January 2021 are...

20 Jan 2021

Business rates update

The government is currently undertaking a fundamental review of the current business rates system,...

14 Jan 2021

Education… education… education

It’s so important, it bears repeating! It seems to be the word on many people's lips at the moment...

12 Jan 2021

What will 2021 have in store for us?

It’s fair to say that last year no-one could predict the Pandemic and the devastation we’ve...

The self-assessment tax return for 2019/20 must be filed by midnight on 31 January 2021. If you...

The Covid-19 pandemic has placed the office Christmas party firmly off the menu this year....

The Accounting Excellence Awards 2020 were targeted at recognising the ‘highs’ in the accounting...

30 Nov 2020

Are you ready for Brexit?

There are new rules for businesses and citizens from 1 January 2021. There is guidance and a...

16 Nov 2020

Five furlough changes you need to know

The government has now published its official guidance for the Coronavirus Job Retention Scheme,...

6 Nov 2020

SEISS grant to be 80% of average profits

The self-employed income support scheme (SEISS) will be open for two further grants, the first of...

5 Nov 2020

Furlough scheme and CBILS extended

In a statement to the House of Commons earlier today (5 November), Chancellor Rishi Sunak set out...

This weekend was a spooky one, and for more than just one reason! Yes it was halloween, but the...

In recognition of the challenging times ahead, the Chancellor said he would be increasing support...

You now have until 30 November to apply for a Coronavirus Business Interruption Loan Scheme...

Over 50,000 taxpayers have used a new online portal to claim tax relief for working at home during...

14 Oct 2020

Covid fraud hotline opens

A new hotline has been launched to report Covid fraudsters who make illegal claims for support.

13 Oct 2020

HMRC receives Airbnb letting data

Landlords should realise that HMRC will know about their lettings through Airbnb, so full...

12 Oct 2020

Sunak tweaks Job Support Scheme for second spike

The Chancellor is aiming to calm fears of a second spike by expanding the Job Support Scheme for...

HMRC has made it easier for self assessment taxpayers to pay the tax they owe incrementally on a...

Local Restrictions Support Grant (LRSG) supports businesses that have been required to close due to...

24 Sep 2020

The Chancellor announces his Winter Economy plan

Today Chancellor Rishi Sunak announced his plans for over the winter period, to help support...

If you don’t have a separate HR system to manage employee information, sick leave, absences or...

10 Sep 2020

Choosing the right structure for your business

Not everyone will have the freedom to choose what legal form their business can take. Depending on...

As an e-commerce business, you rely on efficiency, automation, and accurate information to help you...

Depending on how businesses and self-employed individuals prepare their accounts, there could be...

There are big changes on the horizon for all UK businesses, as the end of the Brexit transition...

17 Aug 2020

The implications of furlough fraud

You're worried about the possible implications of furlough fraud... What are the penalties, how can...

At the beginning of the month the Minister for Regional Growth and Local Government, Simon Clarke...

Online marketplace Amazon is to increase fees for UK sellers next month by 2%, in response to the...

You’re running a restaurant and will be registering for the Eat Out to Help Out Scheme, where you...

23 Jul 2020

VAT and fuel costs on electric cars

If you’re looking to buy a new car, then you’ve probably also been looking at the option of...

Last week the government announced that it would introduce a temporary 5% reduced rate of VAT for...

Budgeting is one of those terms that can either get you excited for the future, or sound like a...

8 Jul 2020

COVID Mini Budget 2020

As predicted the Chancellor announced a number of packages to try and kick start the economy in his...

12 Jun 2020

Avoid the shock - SEISS grants ARE taxable

To support the self-employed during COVID, the government announced its SEISS scheme, providing...

10 Jun 2020

More updates to Coronavirus Job Retention Scheme

Last week we shared a blog covering the main updates to the Coronavirus Job Retention Scheme as...

On Friday 29th May, the Chancellor, Rishi Sunak, announced more details about the extension to the...

At Inform, we’re always looking to find the positives in the face of uncertainty and adversity....

You may have heard stories of businesses seemingly going bust over night. Well, in the majority...

21 May 2020

Tax charges on company vans

Choosing the right van for your business requires consideration of a lot of things; boot space,...

11 May 2020

Calculating statutory redundancy pay

While some help is available to employers through the Coronavirus Job Retention scheme to help them...

Last month, the government announced its Self-employment Income Support Scheme to support the...

Times of crisis such as the one we are currently living through can be a real test, not just for...

Over the last week, the government has announced some new initiatives in an aim to provide...

We know that times are tough at the moment, and that your priorities have most likely changed. And...

It probably goes without saying that you and your business have been impacted by the effects of...

16 Apr 2020

Customer case study: AMS Mortgages

AMS mortgages are a specialist mortgage broker based in Birmingham. Having been with Inform...

24 Mar 2020

Customer case study: Neate & Pugh

Neate and pugh are a specialist employment and HR law firm based in the midlands. Across their 2...

13 Mar 2020

Budget 2020 News

Rishi Sunak received a “hospital pass” when he was appointed Chancellor and was required to deliver...

17 Feb 2020

Budget 2020- Entrepreneurs Relief at risk?

With the new Government's first budget due in just under a month (11 March), there has been...

12 Feb 2020

Customer case study: Probe UK

Probe UK are midlands-based recruitment organisation specialising in the manufacturing sector. Over...

Since 2015, Broster Buchanan, a specialist professional recruitment consultancy, has grown to over...

21 Jan 2020

CGT Reliefs

Investors need to have a clear understanding of what tax reliefs are available to them prior to...

16 Jan 2020

Take a look around our new offices...

To paraphrase the classic saying; “new year, new Inform” - although in truth we haven’t changed...

By the time the end of the tax year swings round, a mad panic often ensues - with taxpayers keen to...

Always keen to keep our fingers on the pulse of the accounting industry, we’ve not long returned...

14 Nov 2019

Paying yourself a salary: What are the most tax efficient options for limited company owners?

If you’re a director-owner of your own limited company though, you can pay yourself a regular...

At the risk of repeating ourselves, cashflow is king for every small business. You can have the...

24 Oct 2019

Get paid to switch your business bank account

Who remembers the banking crisis back in 2008? It seems an age ago, but we are still feeling the...

Most business owners already know the threshold for compulsory VAT registration is a taxable annual...

The ‘off-payroll’ working rules have been proposed to be extended to the private sector from April...

We all know how important it is to plan for retirement these days - and since the introduction of...

By now you’ve probably heard a number of terms floating around in the news and finance sector; open...

10 Sep 2019

How will a ‘No Deal’ Brexit affect EU trading?

Britain is due to leave the EU on 31 October 2019, “no ifs or buts” according to Boris Johnson. So...

9 Sep 2019

VAT rules are changing for builders - but good news, there’s a delay until 1 October 2020!

You might have read that new procedures were expected to be introduced on 1 October 2019, which...

25 Jun 2019

A guide to VAT for e-retail businesses

Thanks to the likes of Amazon’s fulfilment programme, build-your-own website platforms and the...

10 Jun 2019

Gift Aid- a quick guide

Individuals who donate to charity can do so tax-free. There are various ways of making tax-relieved...

10 Jun 2019

How to prepare a quarterly cashflow forecast (and why it’s essential for EVERY business)

Whether your business is flush with cash or struggling to make ends meet, a 13-week cashflow...

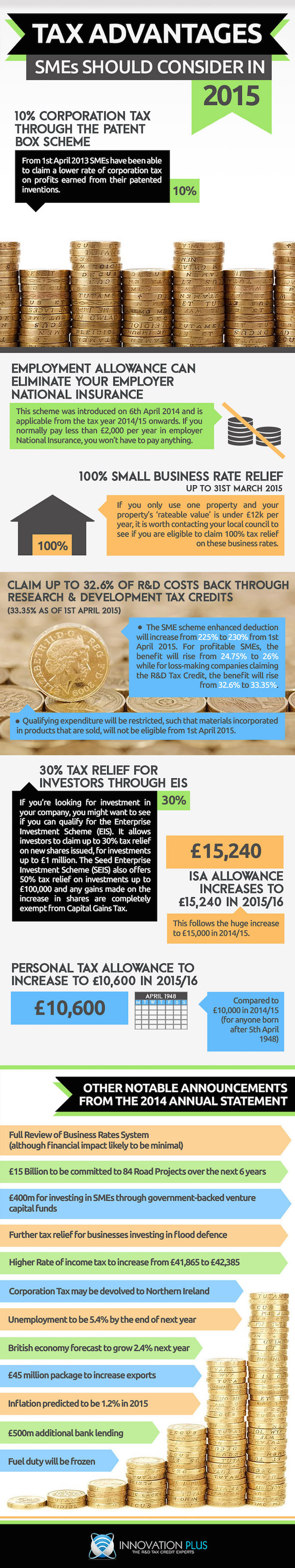

In today’s challenging business environment, SMEs must seize every possible advantage to survive...

3 Jun 2019

Are gifts free of inheritance tax?

Within a family scenario, there are many situations in which one family member may make a gift to...

Today’s technology has made international business more accessible than ever. Armed with little...

With so much continued uncertainty around Brexit and what it might mean for international trade,...

If you’re a frequenter of coffee shops (and let’s face it, who isn’t these days?), you’ll be well...

Where income is mainly derived from savings, it is possible to enjoy tax-free savings income of up...

9 Apr 2019

How to reduce your payments on account

Under the self-assessment system, a taxpayer is required to make payments on account – advance...

After more than two years of back and forth with Brussels, time is very nearly up on the Brexit...

5 Mar 2019

Made a mistake? How to amend your tax return

The deadline for filing the 2017/18 self-assessment tax return of 31 January 2019 has now passed....

Parents affected by the High-Income Child Benefit charge (HICBC) can be forgiven for thinking that...

Where a property is located in a holiday region, a consideration will be whether to let it as a...

26 Feb 2019

Salary v dividend 2019/20

A popular profits extraction strategy for personal and family companies is to extract a small...

If KPMG’s Small Business Accounting Team have been looking after your business accounts, you...

19 Feb 2019

Tax-free investments using Premium Bonds

Premium Bonds (PBs) are an investment product issued and maintained by National Savings and...

5 Feb 2019

Year-end tax planning tips

As the end of the 2018/19 tax year approaches, it is worthwhile taking time for some last-minute...

The annual investment allowance (AIA) allows businesses to obtain an immediate deduction against...

22 Jan 2019

Self Assessment deadline - the clock is ticking…

Got that nagging feeling you’ve forgotten something important? It might just be your 2017/18 tax...

15 Jan 2019

A fresh start for your finances: Why now is the perfect time to revisit your business plan…

Another trip around the sun is complete and January is upon us once more - with the popular ‘New...

Open a store on the high street and your local ‘catchment area’ might extend a few miles. Sell...

First and foremost, a very Happy New Year from all the team here at Inform Accounting. We hope...

The season of giving is upon us once more, and lo and behold, at this time of year, even HMRC gets...

While all new retailers will put their heart and soul into sales and distribution, the returns...

4 Dec 2018

Pass on your house free of IHT

The introduction of the residence nil rate band (RNRB) opens up the possibility of leaving the...

3 Dec 2018

Exciting new apps and MTD updates- here's what you need to know from Xerocon London 2018...

As one of the Midlands’ leading Xero partners, we were recently invited along to Xerocon London...

As a general rule, a deduction is allowed for expenses that are incurred wholly and exclusively for...

19 Nov 2018

Is the Christmas party tax-free?

Although the tax legislation contains an exemption to prevent employees from suffering a...

13 Nov 2018

Xero gets a fresh face

With Xero, a simple experience is a beautiful experience. Xero are simplifying the navigation...

Originating in America, Black Friday has cemented itself as a British shopping staple. In more...

1 Nov 2018

Xero approved by HMRC for MTD

Recent reports in the press (October 2018), have highlighted the fact that HMRC has only fully...

Keeping you up-to-date on the Chancellor’s Autumn Budget announcements.

23 Oct 2018

Cash basis for landlords- when does it apply?

The cash basis simply takes account of money in and money out – there is no need to worry about...

23 Oct 2018

Rent-a-room: New restrictions

Rent-a-room relief offers the opportunity to enjoy rental income of up to £7,500 tax-free from...

16 Oct 2018

HOW creative agencies can make more profit

Managing Director, Sian Kelly, of Inform Accounting shares what businesses in the creative...

16 Oct 2018

Overpaid tax? How to claim it back

There are various reasons why you may have paid more tax than you needed to for a tax year. For...

9 Oct 2018

Savings Income- how is it taxed?

The taxation of savings income can be complicated as there are various allowances and rates that...

The option to pay employees flat rate subsistence expenses tax-free can be an attractive one; the...

It is possible to make gifts during your lifetime free of Inheritance Tax (IHT), as long as you...

17 Sep 2018

High Income Child Benefit Charge

The High Income Child Benefit Charge is effectively a clawback of child benefit paid to ‘high...

11 Sep 2018

Dividend income – How is it taxed in 2018/19?

The taxation of dividend income was reformed from 6 April 2016. Since that date, dividends are paid...

20 Aug 2018

VAT capital goods scheme

The VAT capital goods scheme affects input tax recovery in relation to high value capital assets by...

The introduction of GDPR has led to some major changes in the way businesses deal with personal...

16 Aug 2018

Making Tax Digital- Are you ready?

Recent research has shown that over 40% of small-business owners are still not aware of Making Tax...

The tax system contains a limited exemption for Christmas parties and other annual functions, under...

Private residence relief (also known as main residence relief) takes the gain arising on the...

With the school summer holidays rapidly approaching, HM Revenue & Customs “(HMRC”) have issued a...

Voluntary National Insurance contributions can be paid to plug gaps in your contributions record....

Making Tax Digital (MTD) for VAT starts from 1 April 2019. VAT-registered businesses whose turnover...

13 Jun 2018

Free fuel- is it worthwhile?

Where an employer meets the cost of fuel for private journeys in a company car, an additional...

5 Jun 2018

Do we need to register for VAT?

A business must register with HMRC for VAT if its VAT taxable turnover is more than the VAT...

Every year, more and more businesses are moving their accounts to the Cloud - and as the launch of...

29 May 2018

Number of tax refund scams escalating

A sharp rise in the number of scam emails and text messages targeting taxpayers has been flagged by...

22 May 2018

European Commission- Extension to EMI Scheme

After more than six weeks of uncertainty, the European Commission has approved the extension of the...

18 May 2018

Top Ten Tips for Married Couples...

With two Royal weddings this year, and plenty of excitement around “the dress”, couples who are...

9 May 2018

It's almost here...are you ready for GDPR?

Unless you’ve been hiding in a cave for the last six months (or perhaps just haven’t noticed the...

9 May 2018

Mileage allowances- what is tax free?

Employees are often required to undertake business journeys by car, be it their own car or a...

HMRC do have Task Forces across the UK targeting cash businesses, and in particular those involved...

25 Apr 2018

Jointly owned property- how is income taxed?

Where property is owned jointly by two or more people, the way in which any income is taxed will...

24 Apr 2018

Being ready for Making Tax Digital

The move to Making Tax Digital (MTD) and digital tax accounts is fast approaching. But recent...

24 Apr 2018

Pensions- Protect your lifetime allowance

The pensions lifetime allowance places a cap on overall tax-relieved pension savings. Pension...

The new tax year means that many directors of family companies will be considering the most tax...

As well as the increased flexibility in terms of drawdown arrangements that were introduced in...

14 Mar 2018

Requirement to Correct- The deadline is looming!

UK resident individuals who have offshore interests on which they have not paid the right amount of...

14 Mar 2018

Sian shares her experience in brand new book...

A brand new guidebook for accountants has just been released, featuring business advice and...

14 Mar 2018

Requirement to Correct- The deadline is looming!

UK resident individuals who have offshore interests on which they have not paid the right amount of...

7 Mar 2018

Mileage rates for landlords

In preparation for the introduction of digital recording and reporting, landlords with...

28 Feb 2018

Taxation of savings- what is tax-free?

There is no one answer to the amount of savings income and, for 2017/18, the answer can range from...

Whether you’re a small business, a big multi-national or a sole trader, the way in which you file...

31 Jan 2018

Tax-free rental income up to £8,500

By making the most of the rent-a-room relief and the £1,000 property income allowances, it is...

31 Jan 2018

An introduction to cloud security

Business data is increasingly being stored online in the cloud. What does this mean for your...

24 Jan 2018

Corporate gains – end of indexation allowance

To date, companies have been able to benefit from relief for inflationary gains in the form of...

23 Jan 2018

Claim disincorporation relief while you can

Changes to the taxation of dividends have reduced the tax advantages associated with operating as a...

As the self-assessment deadline looms, it is not only necessary to consider what might be owing for...

The advent of Cloud technology has revolutionised numerous aspects of business, and the fields of...

13 Dec 2017

SDLT- How much will you pay?

Stamp duty land tax (SDLT) was the headline-grabbing measure in the Autumn Budget on 22 November...

6 Dec 2017

Tax-free Christmas Parties

Moderation in all things is the taxman’s motto when it comes to tax-free Christmas parties. The tax...

“BUILDING A BRITAIN FIT FOR THE FUTURE” This was the main theme of the Chancellor Phillip Hammond’s...

Last Wednesday the Inform Accounting team (under the incredibly inventive name ‘Cooking by...

Exciting times here at Inform - we’ve just completed the acquisition of fellow Sutton Coldfield...

14 Nov 2017

What's the benefit of an electric company car?

Despite rising tax charges year on year, many people still enjoy the convenience offered by a...

7 Nov 2017

Letting out your holiday home

If you have a holiday home and decide to let it out, you may be able to benefit from the slightly...

Main residence relief (private residence relief) protects homeowners from any gains arising on...

23 Oct 2017

Calculating your dividend tax bill

Dividends are a special case when it comes to tax and have their own rates and rules. The taxation...

11 Oct 2017

Xerocon London 2017 round-up and show highlights

Xerocon London 2017 was the 5th year Inform has attended Xero’s annual partner conference. As...

As well as helping you run your business finances on a day-to-day basis, Xero also provides a...

27 Sep 2017

Claiming tax relief for employment expenses

In most cases, employees will be able to claim back any expenses that they incur in doing their job...

20 Sep 2017

And the nominees are…

We’re delighted to say we’ve just been shortlisted for the Small Practice of the Year 2017 award -...

Change is on the horizon – from April next year, the self-employed will only pay one Class of...

19 Sep 2017

It’s official…we’re now a Xero Platinum Partner!

We’ve been a proud partner of Xero for a number of years now, helping our clients discover the huge...

12 Sep 2017

How can a loan trust save inheritance tax (IHT)?

A loan trust can be used as a vehicle to save inheritance tax, whilst retaining the ability to...

With rising property costs and low interest rates, many people took out a mortgage to invest in a...

Financial forecasts provide an insightful glimpse forward and are an essential tool for any...

30 Aug 2017

A new start up business- what profits are taxed?

An unincorporated business pays tax on what is known as the `current year basis’. This means that,...

The VAT flat rate scheme is a simplified VAT scheme, which allows small traders (turnover of...

The residence nil rate band (RNRB) is an additional nil rate band, which is available where a death...

Relief may be available where you operate your business through a company and you make a loss.

14 Jul 2017

NI contributions for the self-employed

Following the Spring Budget, the National Insurance treatment of the self-employed hit the headlines

14 Jul 2017

A quick guide to Capital Gains Tax

Capital gains tax is payable on net gains to the extent that they exceed the annual exempt amount.

20 Jun 2017

How to set your small business payment terms

Healthy cash flow is important for any business, but particularly for small business owners in...

20 Jun 2017

Employment allowance- can you benefit?

The National Insurance employment allowance can reduce an employer’s National Insurance bill by up...

Company cars are a popular benefit and are often something of a status symbol. But, they have also...

6 Jun 2017

Making Tax Digital- Voluntary pay as you go

The cash basis is an easier way for smaller businesses to work out their taxable profit. Under the...

Where a pension lump sum is taken, it is possible that too much tax may have been paid. Where this...

26 May 2017

The ISA Round Up 2017

Individual Savings Accounts (ISAs) offer an opportunity to build up tax-free savings income,...

26 May 2017

Making Tax Digital- Extending the cash basis

The cash basis is an easier way for smaller businesses to work out their taxable profit. Under the...

12 May 2017

IHT estate returns

When someone dies, there are forms to fill in and send to HMRC. There are different forms and the...

From 6 April 2016 onwards, bank and building society interest has been paid gross without the...

11 Apr 2017

Can I claim marriage allowance?

The marriage allowance (not to be confused with the married couple’s allowance available where at...

11 Apr 2017

Pricing stories of small businesses

Times were tough, so John decided he had to drop his prices below his competitors. The results...

11 Apr 2017

Pricing stories of small businesses

Times were tough, so John decided he had to drop his prices below his competitors. The results...

The situation where a married couple or civil partners jointly own an investment property that they...

You've poured passion, time, and money into fulfilling a contract, have agreed on payment terms and...

The pensions annual allowance places a cap on tax relieved contributions, which can be made to a...

The start of the new financial year is the perfect time to dust off last year’s business plan and...

The mechanism by which landlords receive tax relief for interest and other finance costs is...

Like all employers, you need to comply with your duties under automatic enrolment – it’s the law....

10 Mar 2017

Chancellor's Spring Budget 2017

Keeping you up-to-date on the Chancellor’s Spring Budget announcements.

On the 1st April 2017 we see an increase to the minimum wages. All employers need to prepare to...

7 Mar 2017

Avoid These 5 Costly Accounting Mistakes

A bank recently surveyed over 500 small business owners about what they love and hate most about...

7 Mar 2017

Overpaid PAYE and how to get it back

There are various reasons why a PAYE overpayment may arise.This can happen simply because an error...

3 Mar 2017

Correcting mistakes in your tax return

Mistakes happen and where a mistake has been made in your tax return it is possible to file an...

In his 2016 Budget speech, the Chancellor announced two new allowances would be introduced from...

21 Feb 2017

First year allowances for cars

It is possible for a business to set the full cost of a car against profits in the year of the...

21 Feb 2017

Update your Business Plan for a New Year

As another year winds down, it’s a good time to reflect on your recent business successes – and...

14 Feb 2017

3 Advantages of Digital Signing for Businesses

Digital signing, versus the traditional "wet" signature, has become increasingly popular in recent...

14 Feb 2017

Are benefits in kind taxable?

Most benefits in kind are taxable and the employee is taxed on the cash equivalent of the value of...

10 Feb 2017

NIC and company directors

Unlike tax, National Insurance is generally worked out separately by reference to the earnings for...

7 Feb 2017

VAT Flat rate scheme – is it for me?

The VAT flat rate scheme is an optional simplified accounting scheme for small businesses. The...

Time consuming and expensive HMRC tax investigations are on the increase. You could be next...

Last Thursday night the Greater Birmingham Chambers of Commerce, Sutton Coldfield, Lichfield and...

24 Jan 2017

The new lifetime ISA- How does it work?

Plans to introduce a new Lifetime ISA were unveiled in the 2016 Budget. The Lifetime ISA will be...

24 Jan 2017

Unlocking your pension age 55 plus

Changes were introduced with effect from April 2015, which provide those aged 55 plus with greater...

Hiring an accountant is widely considered best practice for small business owners. But delegating...

13 Jan 2017

Tax relief for research and development costs

Investing in research and development can be a costly business with no guarantee of recovering the...

"Outsource your weaknesses." So says start-up guru, Sujan Patel, when advising small business...

10 Jan 2017

Mobile phones- a tax-free benefit?

Employers often provide employees with the use of a mobile phone and, structured correctly, they...

10 Jan 2017

Avoid a penalty- File your tax return on time

The deadline for filing the 2015/16 self-assessment online is 31 January 2017. It is important that...

While giving away assets and hoping to live for seven years afterwards can take them out of the...

21 Dec 2016

Disincorporation relief

Recent changes to the tax treatment of dividends may lead people to question whether it may be...

16 Dec 2016

Keeping the Christmas party tax-free

The Christmas party is an annual tradition for many companies, but the frivolities would be...

The old dispensation regime came to an end on 5 April 2016 to be replaced with a new statutory...

25 Nov 2016

10 Money-Saving tips for Freelancers

While working at home as a freelancer sounds like the ultimate dream for anyone who tires of the...

Philip Hammond delivered his 2016 Autumn Statement on 23 November and announced it will be the last...

Although most entrepreneurs recognise the importance of careful financial management, few want to...

Wondering if you're doing everything you can to boost revenue and cut costs? Or if your business is...

If you’re au fait with cloud accountancy platforms like Xero, you’re probably also familiar with...

27 Oct 2016

How to make the most of the personal tax account

The personal tax account is an online tax account for individuals. The personal tax account enables...

Many entrepreneurs believe that hard work and dogged determination are all it takes to build and...

23 Oct 2016

What is changing with Termination Payments?

The Government has been looking at the tax and National Insurance treatment of termination...

19 Oct 2016

3 reasons recurring revenue is a good idea

What is recurring revenue? It's the revenue you can depend on generating, year after year, with a...

14 Oct 2016

5 Ways to Save Money for your Business

Looking for simple ways to cut costs? These tips will help you make a noticeable difference to your...

11 Oct 2016

What is cash basis – is it for you?

As we move closer to a digital age, HMRC have recently published proposals to extend the...

4 Oct 2016

What can employees claim tax relief on?

If you are an employee, you may spend your own money on things that are related to your job. Where...

27 Sep 2016

Cash in hand – beware

It is sometimes mistakenly believed that you do not need to tell HMRC about payments that you...

For small business owners, book-keeping and accounting falls under the category of ‘necessary...

23 Sep 2016

Why won't banks lend to a business?

How to obtain financing is a common concern for new businesses and those preparing to scale....

23 Sep 2016

Why won't banks lend to a business?

How to obtain financing is a common concern for new businesses and those preparing to scale....

20 Sep 2016

Property losses – what can you do with them

For income tax purposes, income from land or property in the UK which is owned by the same person...

16 Sep 2016

Tips to Keep Your Business Finances in Order

If you’re like most small business owners, you spend the majority of your time managing daily...

16 Sep 2016

Tips to Keep Your Business Finances in Order

If you’re like most small business owners, you spend the majority of your time managing daily...

Since 1 April 2016, higher rates of stamp duty land tax apply to purchases of second and subsequent...

While most people know that you do not have to pay capital gains tax on any profit you make on the...

At the time of the 2016 Budget, the then Chancellor, George Osborne, outlined details of a new...

23 Aug 2016

Xero Pointer #11- Integrating Paypal with Xero

Keeping on top of your cashflow means managing the money going out of your business every bit as...

Two months since the UK voted to leave the EU and the dust finally seems to be settling - but it’s...

Auto-enrolment for workplace pensions When it comes to workplace pensions, “we’re all in”. Or so...

3 Aug 2016

Four ways to top up your turnover

For many small businesses, the prospect of getting new customers through the door dominates every...

3 Aug 2016

Ten tax-free benefits in kind

It is possible to provide employees with tax-free benefits where the benefit is covered by an...

In his July 2015 Budget, the Chancellor dealt a blow to landlords with his announcement that from...

3 Aug 2016

Ten tax-free benefits in kind

It is possible to provide employees with tax-free benefits where the benefit is covered by an...

2 Aug 2016

What are the dividend tax rules for 2016/17?

A new set of rules applies to tax dividend income from 6 April 2016 onwards. Under the new rules,...

29 Jul 2016

Overpaid tax last year- how to claim it back

The 2015/16 tax year ended on 5 April 2016. If you have overpaid tax for that year, what do you...

26 Jul 2016

Salary Sacrifice – still worthwhile?

Under a salary sacrifice arrangement the employee gives up part of his or her cash pay in return...

19 Jul 2016

A Trivial Matter- What is a trivial benefit?

A new statutory exemption applies for trivial benefits from 6 April 2016. Trivial benefits are...

19 Jul 2016

Contractor Expenses - An introduction

To most people, there’s not much to distinguish between a consultant, a contractor and a...

12 Jul 2016

Reclaiming tax once director's loan repaid

In family companies, many directors and shareholders maintain loan accounts with the company. As...

Until the end of the 2015/16 tax year, landlords letting furnished properties were able to claim an...

Individuals are able to make tax-relieved contributions to registered pension schemes to the higher...

Until the day we stop calling ourselves accountants and opt for a more glamorous title (all...

21 Jun 2016

New Dividend taxation for 2016/17

The new dividend tax regime came into effect from 6 April 2016. Gone is the dividend tax credit and...

On the back of the Panama papers came the rather unexciting news that the Prime Minister had...

10 Jun 2016

Three ways to better book-keeping

Unless you’ve chosen a career path like ours, book-keeping probably isn’t your idea of a fun Friday...

Keeping on top of your cashflow means managing the money going out of your business every bit as...

In his 2016 Budget speech, the Chancellor announced two new allowances would be introduced from...

31 May 2016

Directors' loans- tax pitfalls

It can be very convenient for the director of a personal or family company to borrow money from the...

27 May 2016

Claim fixed rate deductions to save work

To make life simpler and remove the need to keep detailed records of actual expenses, businesses...

The Chancellor appears to have it in for landlords at the moment. There is the stamp duty land tax...

20 May 2016

Mileage Expense Tracking with the Inform app

Have you downloaded the Inform Accounting app yet? Available free for iPhone and Android, it...

17 May 2016

Claiming marriage allowance – are you eligible?

For 2015/16 and later tax years, the marriage allowance allows married couples and civil partners...

You might recall a recent blog post in which we highlighted ‘the difference between cashflow and...

10 May 2016

New dividend allowance

Question: When is an allowance not an allowance? Answer: When it is the dividend allowance. The...

6 May 2016

A virtual CFO for your small business

In big multinational corporations, the role of the Chief Financial Officer (CFO) is key. Indeed,...

For the uninitiated, a bank reconciliation is a process used to compare your books to your bank- to...

A benefit-in-kind tax charge arises when a company car is also available for private use. The...

Cash flow and profitability - two of the accountancy industry’s favourite phrases, and words you’ll...

26 Apr 2016

Reducing your payments on account

Under the self-assessment system, an individual is required to make payments on account. These are...

Most people are aware of the existence of the capital gains tax exemption for their only or main...

When you’re looking to appoint a new accountant to look after your creative agency finances, does...

15 Apr 2016

VAT for business, explained

VAT. Three little letters, one big mystery to many a new business owner (and let’s be honest,...

15 Apr 2016

BUDGET APRIL 2016 TAX CHANGES

In this blog we focus on tax changes announced in the March 2016 Budget and other measures taking...

12 Apr 2016

100% capital allowance for low-emission cars

Cars do not qualify for the annual investment allowance, but by choosing a low or zero emission car...

8 Apr 2016

Giving your home away – beware the GWR rules

It is possible to escape inheritance tax on gifts by surviving for seven years after the date of...

Hosting your accounts in the cloud comes with the benefit of being able to track your finances from...

29 Mar 2016

Business premises renovation allowance (BPRA)

Business premises renovation allowance (BPRA) was introduced as an incentive to encourage...

From Xero to Receipt Bank to Vend, we do love a good accounting app. Indeed, anything that puts...

22 Mar 2016

Mileage allowance relief