With increasing pressure on NHS budgets, many pharmacies have suffered cuts to funding over recent years - a bitter pill to swallow for businesses so vital to our communities.

At the same time, a period of rapid technological change has led to increased expectations on service, providing yet more challenges for one of the oldest industries around.

These challenges, and others, have made it harder than ever for pharmacies to make the numbers add up. But at Inform, we can help you make sense of it all, building profitability into your business for a healthier financial outlook.

We’ll make your bookkeeping a breeze and empower your business decisions - while saving you more time to serve the community that depends on you.

Vastly experienced in handling pharmacy accounts, our financial advisors are perfectly placed to help you meet the needs of a changing industry.

Whether you need support with your statutory accounts and VAT returns in light of the new Making Tax Digital era, or you want business growth advice to boost your bottom line, we’re here to take all those financial pains away.

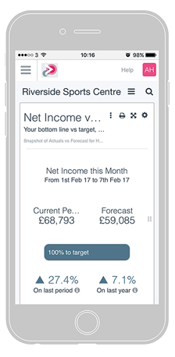

Crucially, by setting you up with cloud-based accounting platform Xero, we unlock access to your real-time financial information, helping you make better decisions for the future of your pharmacy.

It makes it easier for you to share that financial information with us too, making traditional paper-based accounting a thing of the past.

Increasing pressure on NHS budgets and a period of rapid technological change has led to increased expectations on service, providing yet more challenges for one of the oldest industries around. In this guide for pharmacies, we take a look at some of the key benchmarks used in the pharmaceutical industry to measure success, and how you can implement these.

Don't lull yourself into a false sense of security, by only setting a budget for your income/profit and loss statement.

We'll help you understand the relationship between your balance sheet, cash flow and P&L, so you're in more control.

And because it's real-time, you'll be able to access your numbers anywhere and on any device to see your current financial position.

At Inform Accounting, what we do is about so much more than making money and helping our clients manage theirs.