BLOG

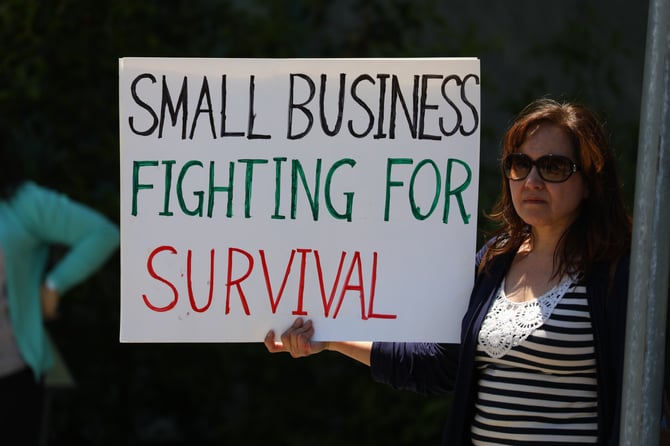

Chancellor increases financial support for businesses and workers

In recognition of the challenging times ahead, the Chancellor said he would be increasing support through the existing Job Support and self-employed schemes and expanding business grants to support companies in high-alert level areas.

HM Treasury states that open businesses which are experiencing difficulty will be given extra help to keep staff on as the Government will increase contributions to wage costs under the Job Support Scheme, and business contributions drop to 5%.

Business grants are expanded to cover businesses in particularly affected sectors in high-alert level areas.

Grants for the self-employed doubled to 40% of previous earnings.

Job Support Scheme (JSS)

When originally announced, the JSS – which starts on 1 November, saw employers paying a third of their employees’ wages for hours not worked and required employees to be working 33% of their normal hours.

Today’s announcement reduces the employer contribution to those unworked hours to 5%, and reduces the minimum hours requirements to 20%, so those working just one day a week will be eligible. That means that if someone was being paid £587 for their unworked hours, the government would be contributing £543 and their employer £44.

Self-employed grant

Today’s announcement increases the amount of profits covered by the two forthcoming self-employed grants from 20% to 40%, meaning the maximum grant will increase from £1,875 to £3,750.

Business Grants

The Chancellor has also announced approved additional funding to support cash grants of up to £2,100 per month primarily for businesses in the hospitality, accommodation and leisure sector who may be adversely impacted by the restrictions in high-alert level areas. These grants will be available retrospectively for areas who have already been subject to restrictions and come on top of higher levels of additional business support for Local Authorities moving into Tier 3.

These grants could benefit around 150,000 businesses in England, including hotels, restaurants, B&Bs and many more who are not legally required to close but have been adversely affected by local restrictions.

More information about today's announcement can be found here.

Read more of Inform's tax blogs:

Live page: Accounting advice during business disruption

It's that wonderful time of the year...for fraudsters to pray on taxpayers!

Paying yourself a salary: What are the most tax efficient options for limited company owners?

Four key cashflow issues that could cripple your business (and how to avoid them)...

.jpg?width=1500&height=1000&name=amy-hirschi-K0c8ko3e6AA-unsplash-(5).jpg)