BLOG

Paying subsistence expenses using benchmark rates

Under the terms of the exemption, employers can pay or reimburse certain subsistence expenses using benchmark rates set out in regulations. Prior approval from HMRC to use the rates is not needed. The rates represent the maximum amounts that can be paid free of tax and National Insurance without agreeing a bespoke rate with HMRC. It is not compulsory for the employer to pay the benchmark rates – rates lower than those set out in the regulations can be paid and remain within the scope of the exemption.

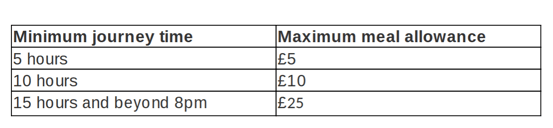

The rates

The subsistence rates depend on the journey time and are as set out below. A `meal’ takes its normal everyday meaning of a combination of food and drink.

If the five-hour or ten-hour rate is paid and the qualifying journey in respect of which the allowance is paid lasts beyond 8pm, a supplement of £10 can also be paid. Where employees are required to start late or finish early on a regular basis, the five-hour or ten-hour rate, as applicable, can be paid.

Qualifying conditions

The benchmark rates can only be used if the qualifying conditions are met. These are as follows:

The travel must be in the performance of the employee’s duties or to a temporary workplace. Journeys which are the normal journey to and from work do not count.

The employee should be away from his normal workplace or home for five hours or ten hours, as appropriate.

The employee must have incurred expenditure on a meal and retained a receipt as evidence.

Tip

The full rates can be paid even if the actual amount spent by the employee was less than the benchmark rates. Use of the rates saves work for the employer.

Tip

If the employee spent more than the amount reimbursed, they can claim a deduction for the shortfall as long as they have kept the receipt.

Trap

If the employer pays more than the benchmark rate without agreeing a bespoke rate, the excess is taxable and liable to NICs.

Bespoke rates

Should you need further advice on paying subsistence expenses using bench mark rates or for any other tax related matters get in touch with Inform.

Read more of Inform's tax blogs:

Inheritance tax and property- the rules

How to make the most of the personal tax account

.jpg?width=1500&height=1000&name=amy-hirschi-K0c8ko3e6AA-unsplash-(5).jpg)