BLOG PERSONAL TAX COMPANY TAXES, EXPENSES & RATES

Tax Rates & Reliefs

On 15 March 2023, Chancellor Jeremy Hunt presented his first Budget to Parliament and set out a plan to reduce inflation, grow the economy and get government debt falling all whilst avoiding a recession and tackling labour shortages.

In this blog we set out some of the main tax rates.

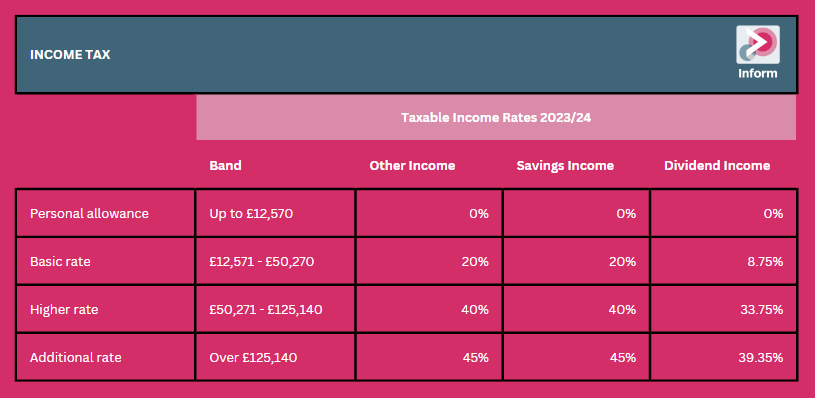

INCOME TAX

The personal allowance and basic rate band threshold are now frozen in place until 5 April 2028. As earnings increase, individuals will move into higher tax bands. This is often referred to as ‘fiscal drag’ because it will raise more tax without the government increasing income tax rates.

The personal allowance continues to be partially and then fully withdrawn for higher earners, with £1 of personal allowance lost for every £2 of adjusted net income over £100,000.

Income tax rates in Scotland and Wales on income other than savings and dividend income have been devolved.

Savings Income

Savings income continues to benefit from a personal savings allowance of £1,000 for basic rate taxpayers and £500 for higher rate taxpayers.

Dividend Income

Dividend income attracts a £1,000 dividend allowance in 2023/24, down from the £2,000 allowance seen in previous years. These allowances are in addition to the personal allowance and attract a 0% rate of income tax.

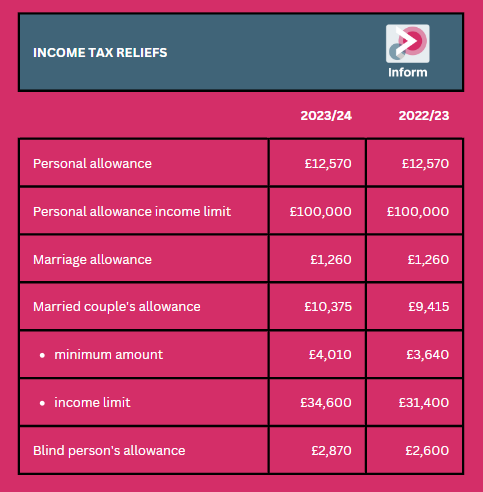

INCOME TAX RELIEFS

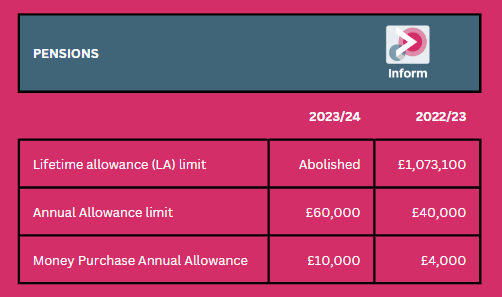

PENSIONS

CORPORATION TAX

Special rules apply to companies with accounting periods straddling 1 April 2023.

Where a company’s profits fall between £50,000 and £250,000 a year, the profits are taxed at the higher 25% rate, but a ‘marginal relief’ is given to reduce the liability, with the effective rate being closer to 19% for those with profits just over £50,000.

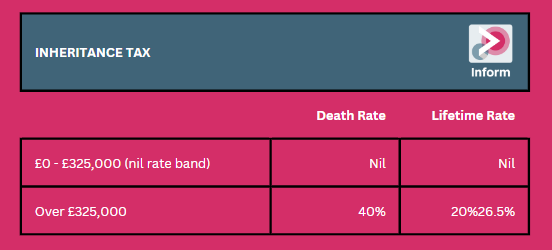

INHERITANCE TAX

The residence nil rate band will also remain at £175,000 and the residence nil rate band taper will continue to start at £2 million.

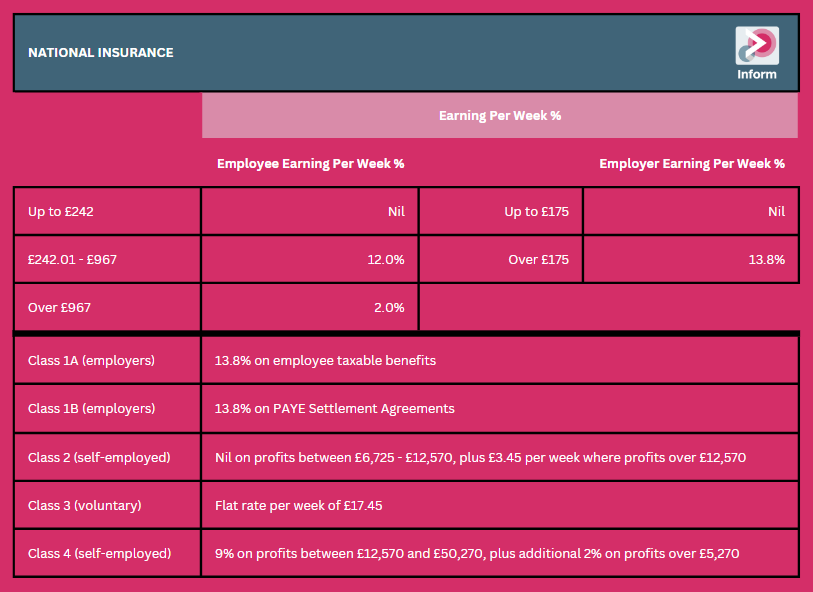

NATIONAL INSURANCE

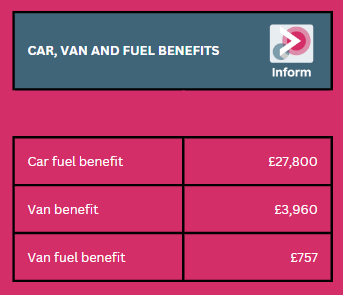

CAR, VAN AND FUEL BENEFITS

The exact CO2 figure is always rounded down to the nearest 5 grams per km — (with some exceptions). For example, CO2 emissions of 188 grams per km are treated as 185 grams per km.

For diesel cars, the general rule is to add a 4% premium, unless the car is registered on or after 1 September 2017, but the cap is still 37%.

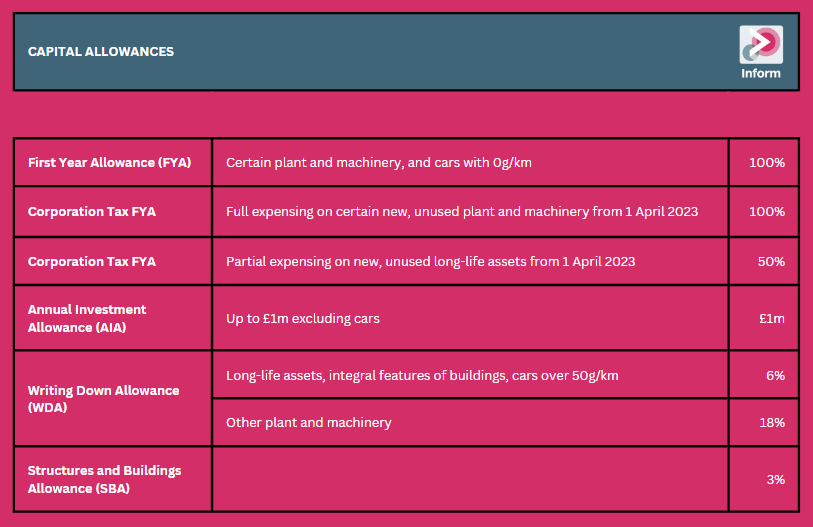

CAPITAL ALLOWANCES

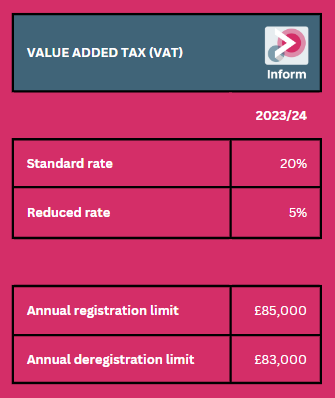

VALUE ADDED TAX

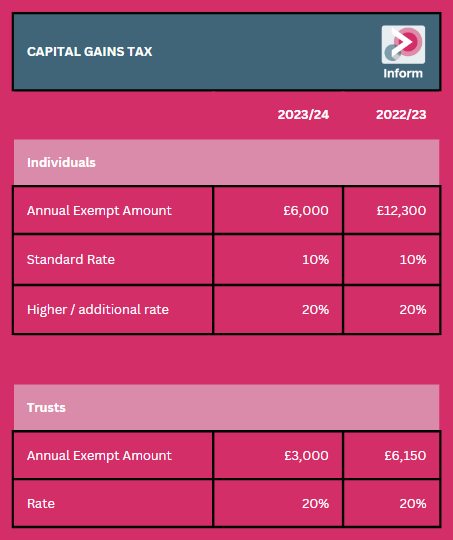

CAPITAL GAINS TAX

Higher rates (18% / 28%) may apply to the disposal of residential property.

Business Asset Disposal Relief (BADR)

The first £1m of qualifying assets are charged at 10%.

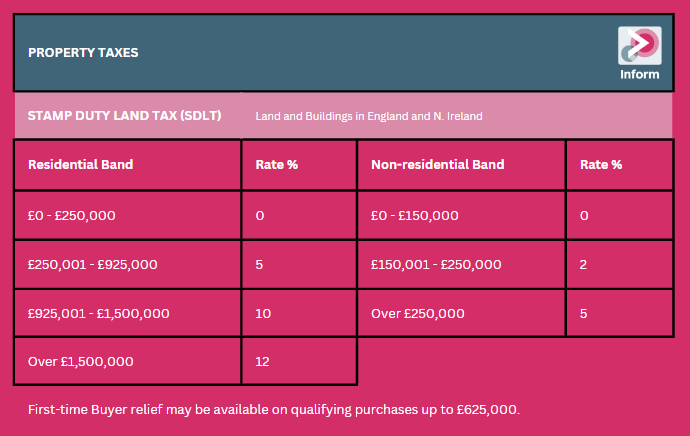

PROPERTY TAX

There is an additional rate of 3% where a buyer is buying a second (or more) residential property.

DISCLAIMER

Rates are for guidance only. Whilst we take care to ensure the accuracy of this document, no responsibility for loss occasioned by any person acting or refraining from action as a result of this information can be accepted by the authors or firm.

.jpg?width=1500&height=1000&name=amy-hirschi-K0c8ko3e6AA-unsplash-(5).jpg)