BLOG APPS & PARTNERS

Business Loans - simplified with IWOCA

Inform Accounting are proud to partner with iwoca, a specialist small business lender who have supplied over 90,000 SMEs with finance since 2012.

If you’re looking for some short term funds to purchase stock, invest in growth or just keep your cash flow smooth, iwoca might be for you.

Iwoca loans are purpose built for small businesses, with simple pricing and quick decisions. We only need your basic business details and a few documents to get a decision, and applying won’t impact your credit score.

The Application Process

-

One of our team will be in touch to discuss your request and to gather any extra information we need to start the funding application with our partners.

-

We’ll manage the application process for you, deal with any requests from iwoca and get the fastest decision we can back to you - so you can keep running your business in the meantime.

-

If your application is successful, you’ll receive an offer to accept.

-

Once you’ve accepted the offer, the funds will be transferred to your chosen bank account within 48 hours (often the same day!).

Who can apply?

-

Any UK based Limited company

-

Any business age (recommended 12 months)

-

Any business sector

-

Non-homeowners eligible

-

Borrowing for business purposes

PRODUCTS

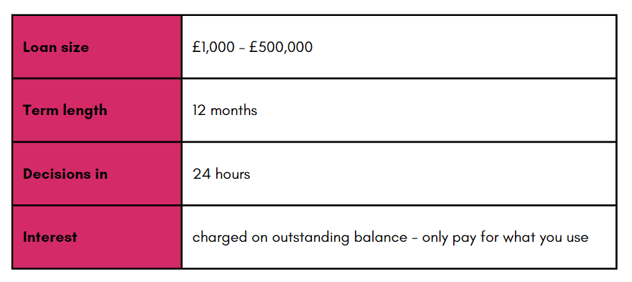

Flexi-Loan

The short term loan product, designed to help manage cashflow with flexibility in mind.

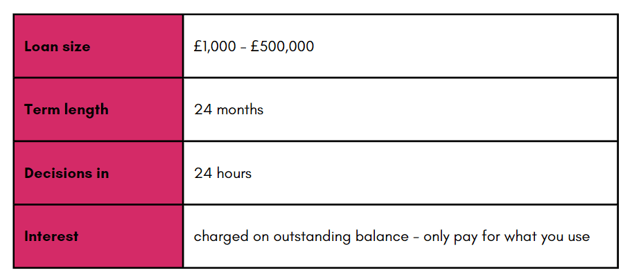

Flexi-24

Spread the cost over a longer term, perfect for investing into growth opportunities.

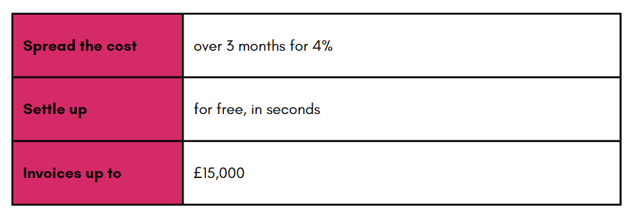

iwocaPay

Get your invoices paid sooner by offering flexible payment options without the risk.

Transparency statement

Inform Accounting receives commission on each successful funding application referred to partners through us.

.jpg?width=1500&height=1000&name=amy-hirschi-K0c8ko3e6AA-unsplash-(5).jpg)