Supporting your growth story

Behind every brand-new business there’s a burning passion to succeed - but longevity depends on using your head, not just going with your heart.

More than half of start-ups fail within the first four years, and it’s vital to build profitability into your business from the very beginning if you’re to avoid becoming another statistic

From the formation of your limited company to the set-up of your payroll, getting early decisions right will be crucial, and we’re here to help you make them.

We’ll also get you set up with specialist accounting software designed to ease the book-keeping burden - giving you more time to focus on building your empire.

Much more than just a traditional end-of-year accountant, we can give your business the support it needs from the off - guiding you through the incorporation process, VAT registration, PAYE and more.

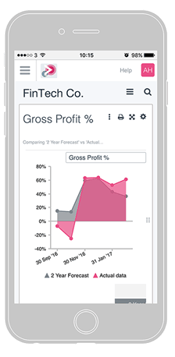

And with the real-time cloud accounting platform, Xero (which gives us live access to your numbers at any time), we’re on hand to support your business-decision making at a moment’s notice.

The leading Xero accountant in Birmingham, we’ve been working with technology companies and start-ups across the Midlands for years - and we're proud of how the region has grown.

Nothing would please us more than to play a part in your growth story too…

Need help setting and achieving your goals? The KPIs listed in this guide will help provide the insight you need to keep your business growing. We can help you set your targets, track your data and report back through the provision of management accounts - a monthly or quarterly set of statements that put you firmly in control of your finances.

Driving sustainable growth isn't easy. You've got to balance customer acquisition with a scalable operation to ensure you deliver effectively, while making sure you don't burn too much cash.

Financial insight is critical to getting this balance right, ensuring the timing of and rationale behind your decisions takes you forward.

We'll give you the platform to view your numbers in real-time, with expert advice to help you make the right strategic choices.

At Inform Accounting, what we do is about so much more than making money and helping our clients manage theirs.