BLOG

Second homes – buy now to avoid SDLT supplement

One of the Chancellor’s shock announcements of the 2015 Autumn Statement was that a new 3% SDLT supplement would apply for second residential properties. The supplement comes into effect from 1 April 2016.

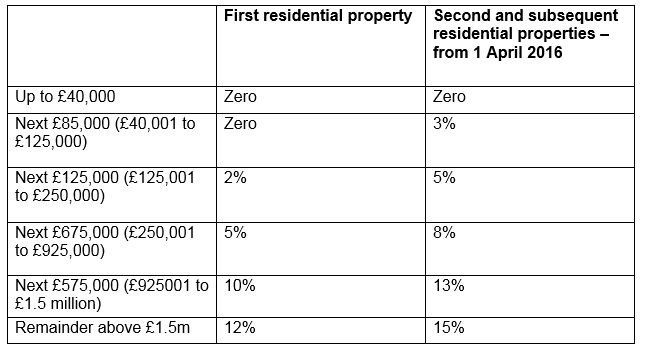

Under the proposals, higher rates of SDLT will be charged on purchases of additional residential homes, such as buy-to-let properties and second homes. The higher rates will apply to second and subsequent residential properties costing more than £40,000. The higher rates will be 3% higher than those currently applying to residential property.

The rates are summarised in the following table.

Case study

Jacob wants to buy an investment property to let out. He finds one he likes in January 2016. The property costs £300,000.

If he completes before 1 April 2016, he will not pay the supplement and will pay SDLT of £5,000 ((£12,000 @ 0%) + (£125,000 @ 2%) + (£50,000 @ 5%)).

However, if he completes after 1 April 2016, he will be liable to the supplement and will pay SDLT of £12,800 ((£40,000 @ 0%) + (£85,000 @ 3%) + (£125,000 @ 5%) + (£50,000 @ 8%)).

Completing after 1 April 2016 will increase the stamp duty payable by £7,050 (being (£300,000 - £40,000) @ 3%).

Taking steps where at all possible to complete before 1 April 2016 can save significant amount of stamp duty.

Special cases

Under the proposals, the supplement rates will not apply in a situation where the main residence is replaced, even if the purchaser owns more than one residential property once the transaction is complete. This may arise if there is a delay in selling the original main residence (such as for an overlap period when both the old and new main residences are owned). Where this happens, the higher rates will initially apply, but the difference between the higher and normal rates will be refunded if the original main residence is sold within 8 months.

It is also proposed to introduce an exemption from the higher rates for corporations and funds with at least 15 residential properties.

If you need further advice on how to avoid SDLT supplement or information on any other tax related matters please get in touch with us at Inform.

Read more of Inform's tax blogs:

Business property relief- what business assets qualify?

.jpg?width=1500&height=1000&name=amy-hirschi-K0c8ko3e6AA-unsplash-(5).jpg)