BLOG

A fresh start for your finances: Why now is the perfect time to revisit your business plan…

Another trip around the sun is complete and January is upon us once more - with the popular ‘New Year, new you’ message out in full force.

Another trip around the sun is complete and January is upon us once more - with the popular ‘New Year, new you’ message out in full force.

In 2019 though, why not extend this philosophy to your business?

The dawn of a new year brings with it new challenges, fresh competition and revised goals, so January is the perfect time to dust off your business plan and bring it up to date.

For many, of course, the first step to updating your business plan will be finding it! To lots of small business owners, a business plan is something produced at the company’s inception, then tucked away in a desk drawer never to see the light of day again.

In reality though, your business plan should be a living, breathing document, updated every year to arm your business with a 12-month plan of action.

It should include your short-term and long-term goals, and outline your current and potential issues - helping to realign your business focus in the face of ever-evolving market pressures.

So, if you find yourself with a little bit of breathing space now that the Christmas period is over, take the opportunity to refresh, review and update your business plan for the forthcoming year. Here’s how to go about it:

Start with your VMOs…

Vision (V) → Mission (M) → Objective (O)

Your vision, mission and objective underpin the key aims and purpose of your business - but even they can change over time.

Have events from the last year changed any of your objectives? Are there new goals that you want to achieve moving forwards, or specific targets for the forthcoming 12 months?

Setting new targets and growth plans has been shown to bring fresh motivation to teams, and could be the key to a productive year.

Staff Planning

Speaking of teams and productivity, a fundamental part of your business plan review should be a look at your staffing situation.

You chose the people in your team for a purpose - but are they living up to your expectations? As hard and personal as it may feel, conducting staff reviews is important to help you to determine any team members who may be underperforming (and either need incentivising, re-training or letting go).

If you’re looking to grow the business over the forthcoming year, you may also need to look at your staffing profile from a capacity perspective. Will your current team be able to cope with new contract wins, or do you need to increase your numbers?

Reviewing Your Finances

Like most elements of a growth strategy, bringing new team members on board costs money - so if this is a year for scaling up, it’s going to be vital to stay on top of your finances.

A financial assessment should therefore form a core part of your business plan review, to see where you’re at and identify any forthcoming cashflow peaks and troughs.

Cash is the lifeblood of all businesses - without it you can’t pay your bills, your staff, and everything comes to a standstill - but with the right planning in place, you can ride out even the most troublesome of times to keep on building your business.

Financing options play a big part here, allowing you to plug those shortfalls as and when they arise.

At Inform, we’ve partnered with some of the market leaders in the business finance sector, from short-term financiers like IWOCA (offering up to £200,000 repayable on a variable month basis), to longer-term finance and loan companies like Capitalise and Marketinvoice, who provide options including invoice and contract financing.

Aside from supporting your funding requirements, we can also we offer budgeting and cashflow forecasting services, to help translate your plans into figures that make sense.

Market Analysis

The modern-day business environment is in constant motion, and that can be a daunting thought - knowing that what was once guaranteed business may no longer be so secure.

Your new business plan should therefore not only focus on your own circumstances and objectives, but also take a renewed look at your competitors and the wider market in which you operate.

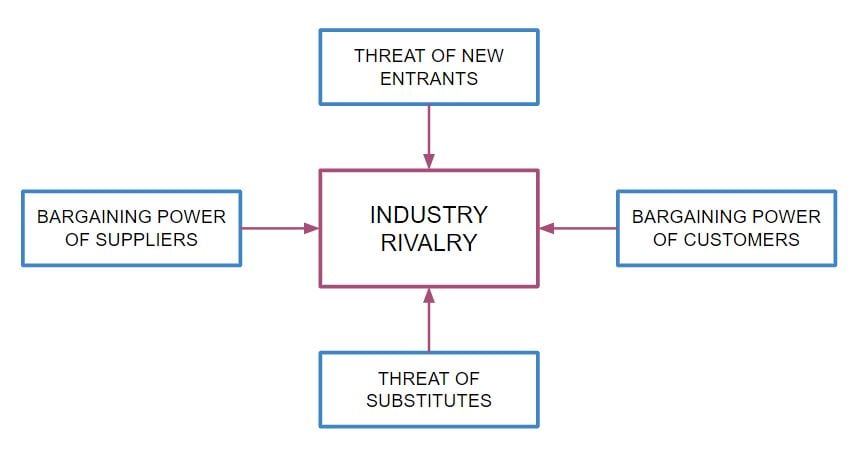

Conducting some form of market analysis such as SWOT (strengths, weaknesses, opportunities and threats) or using proven models like Porter’s Five Forces (below) can help you to identify important areas that may need additional attention this year to increase your competitive advantage.

Need support to grow your business this year? Still not sure where to start with your business plan review?

For business planning advice and ongoing support with cashflow and budgeting, just give the Inform team a call on 0121 667 3882 You can also email us on hello@informaccounting.co.uk

Read more of Inform's tax blogs:

Going global? Here's how VAT works on international e-commerce sales...

.jpg?width=1500&height=1000&name=amy-hirschi-K0c8ko3e6AA-unsplash-(5).jpg)