Like so many industries at the moment, the professional services sector is undergoing a time of real transition.

Digital disruption means competition in the legal and financial marketplace is at an all-time high - with clients increasingly expectant of high-speed, high-quality service driven by new technologies.

As professional service firms scramble to try and meet that demand, it’s putting the industry’s traditional resourcing models under pressure too.

With all these challenges to face, it’s more important than ever to build your business on solid financial foundations.

As one of the leading Xero accountants in Birmingham, we’ve built our business around cloud technology - so we certainly know a thing or two about the tech-disrupted professional services space.

We use our own innovative approach to help firms get ahead of increasing competition, unlocking access to your real-time financial data to help you make better business decisions.

Of course, we’ll support you with your statutory accounts, VAT returns and bookkeeping too, but it’s our business growth and advisory services that can really add value to your firm.

And, as you look to solve your resourcing issues by tapping into the on-demand workforce trend, we’ll be right here to help you navigate the complexities of PAYE and IR35 too.

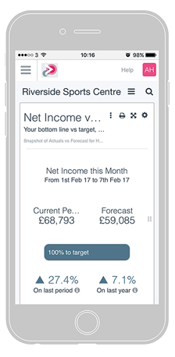

Need help setting and achieving your goals? The KPIs listed in this guide will help provide the insight you need to keep your business growing. We can help you set your targets, track your data and report back through the provision of management accounts - a monthly or quarterly set of statements that put you firmly in control of your finances.

Don't lull yourself into a false sense of security, by only setting a budget for your income/profit and loss statement.

We'll help you understand the relationship between your balance sheet, cash flow and P&L, so you're in more control.

And because it's real-time, you'll be able to access your numbers anywhere and on any device to see your current financial position.

At Inform Accounting, what we do is about so much more than making money and helping our clients manage theirs.