BLOG

The MTD Timeline - know your responsibilities

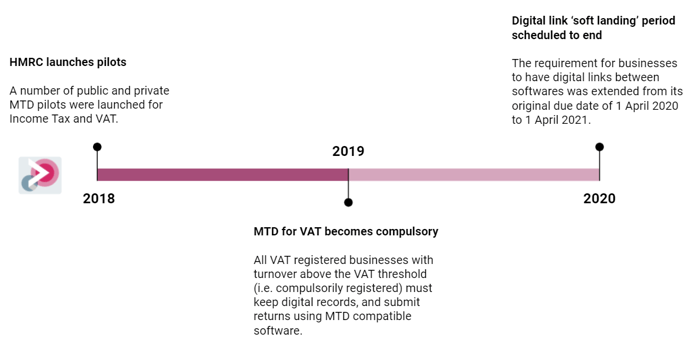

Making Tax Digital, or ‘MTD’ for short, is an initiative taken by HMRC to digitise the tax administration process in the UK. To do this, significant changes have had to be made to how businesses are required to store and report on their taxes.

Due to the size of the change, the MTD initiative has been split into ‘manageable chunks’ to allow HMRC to develop systems, manage queries, and also to allow businesses to implement necessary changes to their systems in stages.

The idea for moving towards a digital system, is that it is intended to make the tax reporting process:

- More effective

- More efficient

- Easier for taxpayers to get their tax right

The story so far

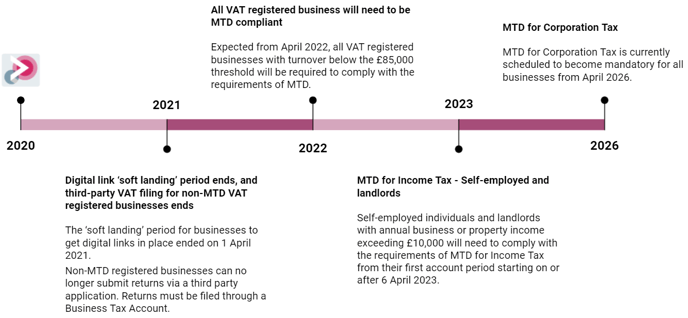

The future of MTD

You can see all the scheduled MTD changes on the GOV website here.

Please note, that to encourage VAT registered businesses and individuals not currently registered for MTD for VAT, HMRC has removed the ability for these VAT returns to be filed using third-party software such as Xero. Instead, you can continue to use the software to calculate your VAT returns, however submission will need to be made via your Business Tax Account. This move is ahead of the mandatory requirement for all VAT registered businesses to file through MTD from April 2022.

Get in touch

If you’re looking for an accountant with a history of working with technology, look no further. As winners of the Digital and Innovative Firm of the Year 2021 (Accountancy Excellence Awards), who else is better placed to support you on your MTD journey? Get in touch with us today to find out how we can help.

.jpg?width=1500&height=1000&name=amy-hirschi-K0c8ko3e6AA-unsplash-(5).jpg)