BLOG

Landlord–interest relief restriction: deduction v tax reduction

In his July 2015 Budget, the Chancellor dealt a blow to landlords with his announcement that from April 2017 relief for finance costs would be progressively restricted. In giving effect to the restriction, landlords would move from the current position where they are able to deduct finance costs, such as mortgage interest, in full when computing their rental profits, to one where relief is given as a basic rate tax reduction.

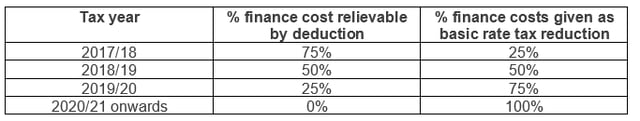

Phased in

The switch from deduction to interest rate reduction is to be phased in over four years, with a gradual shift away from deducting property finance costs from property income.

Deduction v basic rate tax reduction

Where relief is given by deduction, the landlord obtains tax relief at his marginal rate of tax. The property finance costs are deducted in arriving at the taxable profit and that profit is taxed at the landlord’s marginal rate of tax.

By contrast, where relief is given as a tax reduction, the rental profit is first calculated without taking account of the finance costs relieved by tax deduction and the tax is worked out on those profits. Effect is given to the basic rate tax reduction by deducting an amount equal to the finance costs x the basic rate of tax from the tax figure initially computed on the profits.

Example

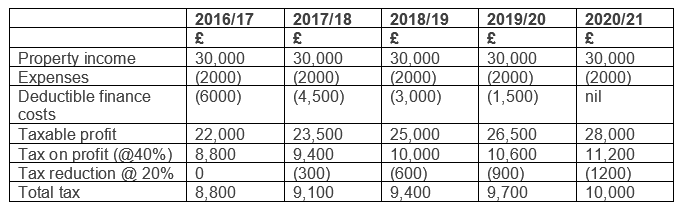

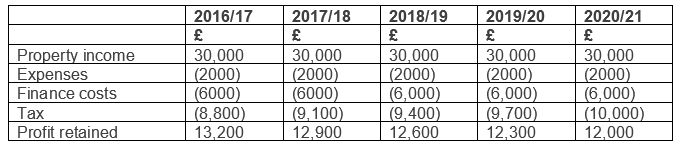

Ian is a landlord. In each year from 2016/17 to 2020/21 inclusive, he has property income of £30,000. He pays mortgage interest costs of £6000 and incurs other expenses of £2000. He also has a salary of £60,000 and pays tax on his property income at the higher rate of 40%.

His tax position for each of the years is as follows:

Summary

As a result of the shift from relief by deduction for 100% of property finance costs to relief by basic rate reduction for 100% of finance costs, Ian’s retained profit is reduced by £1,200.

Sting in the tail

Moving from deduction to tax reduction has hidden costs. The relief is given later in the calculation, which has the effect of increasing the taxpayer’s taxable income. This may move him into a higher tax bracket or trigger the high income child benefit charge or the abatement of the personal allowance.

Please get in touch with us at Inform if you need further advice on landlord- interest relief restriction or for any other tax related matters.

Read more of Inform's tax blogs:

What are the dividend rules for 2016/17?

Overpaid tax last year- how to claim it back

.jpg?width=1500&height=1000&name=amy-hirschi-K0c8ko3e6AA-unsplash-(5).jpg)