BLOG

Property losses – what can you do with them

For income tax purposes, income from land or property in the UK which is owned by the same person or group of persons is treated as forming a property rental business. Tax is charged by reference to the profits of the business as a whole, rather than by reference to each individual property. This means that as profits of one property are netted off against losses of another, there is no need to consider what to do with losses unless the business as a whole makes a loss.

Example

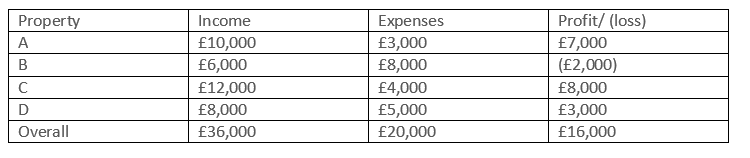

Wayne has a property portfolio comprising four properties, A, B, C and D. For the tax year in question, the income and expenses in relation to each property are as follows:

As all of the income and expenses from all of the properties in the property rental business are effectively thrown into the pot to determine the profit or loss for the property rental business as a whole, the loss on property B is automatically relieved against profits of the other properties to arrive at the overall profit for the property rental business as a whole of £16,000.

Loss for the business as a whole

If the property rental business as a whole makes a loss, as will be the case if the expenses incurred in relation to all properties forming the property rental business are greater than the income from all the properties, the loss can only be carried forward and set against future income from the same property rental business. The options available for relieving a trade loss, such as against other income of the same tax year, are not available in relation to property income losses, which essentially remain within their own channel. The exception to this rule is where the rental business capital allowances are due, in which some or all of the capital allowances element of the loss can be set against general income.

Example

In 2014/15, Tony makes a loss of £4,000 in respect of his property rental income. In 2015/16 he makes a profit of £6,000. The loss from 2014/15 is carried forward and set against the profits of 2015/16, leaving profits of £2,000 to be assessed in 2016/17 (the profits for that year of £6,000 less the loss of £4,000 carried forward from 2014/15).

Losses in a furnished holiday lettings business can now only be carried forward and set against future profits from that furnished holiday business.

If you need further advice on 'property losses - what can you do with them' or for any other tax related matters please get in touch with us at Inform.

Read more of Inform's tax blogs:

Business and private use- what can you claim?

Landlord-interest relief restriction: Deduction v tax reduction

What are the dividend rules for 2016/17?

.jpg?width=1500&height=1000&name=amy-hirschi-K0c8ko3e6AA-unsplash-(5).jpg)