BLOG

What is the most tax efficient salary in 2022/23?

The age-old question for many directors is whether they should take a salary, dividends, or both. So as we enter the new tax year, what is the most tax efficient way for a director to draw money 2022/23?

Key tax changes for 2022/23

- The employment allowance has increased to £5,000.

- National Insurance Contributions (NICs) and dividend tax rates are increasing by 1.25% to support the NHS, health and social care.

- National Living Wage and Apprenticeship Wage limits are being increased.

For more information on these key tax changes, take a look at our blog Changes affecting staff costs and dividends from April 2022.

Employees

Minimising Employee’s NIC

In order for employees (including directors) to qualify for the State Pension, and other state benefits, it’s important that they are paid at least the lower earnings limit (LEL) which is £123 for the tax year 2022/23.

In order to minimise the amount of employee NICs to pay, the most beneficial salary to pay employees is £123 to £190 per week (from 6 April 2022 to 5 July 2022), and then £123 to £242 (6 July 2022 to 5 April 2023).

As Director pay is calculated on an annual basis, the annual limits are £6,396 to £11,908 for each of the respective dates above.

Minimising Employer’s NIC

To reduce the employer’s NIC cost, the most efficient salary level is £123 to £175 per week (£6,396 to £9,100 pa).

The employment allowance has now increased to £5,000 for tax year 2022/23 (previously £3,000), so if this is available to the company, it is more tax efficient to pay a slightly higher salary, as the extra cost will be covered by this employment allowance.

Exceptions

There are some exceptions to NIC thresholds, such as veterans and individuals over the state pension age. You should always seek independent professional advice for your (or your employee’s) specific circumstances.

Matchmakers in the making

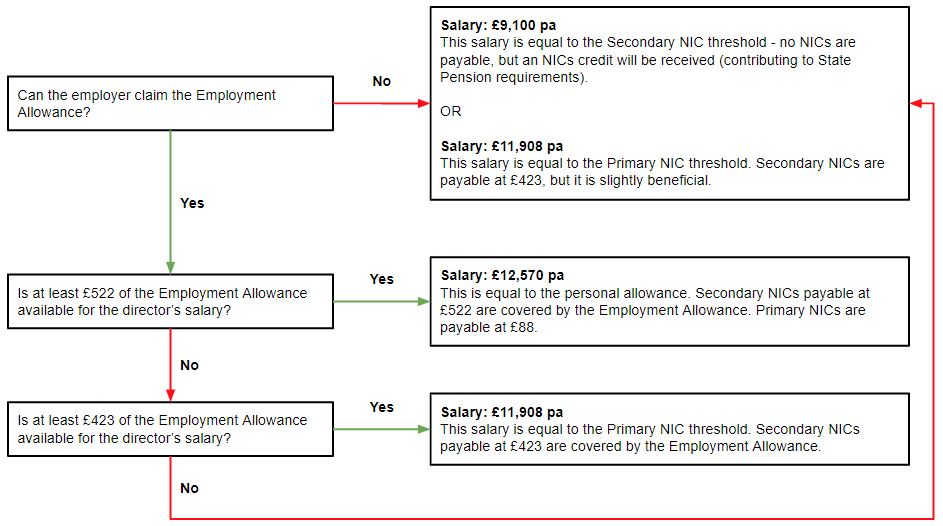

Since the salary that is most beneficial is dependent on a number of factors, we’ve put together this simple flow diagram to help you find your perfect match.

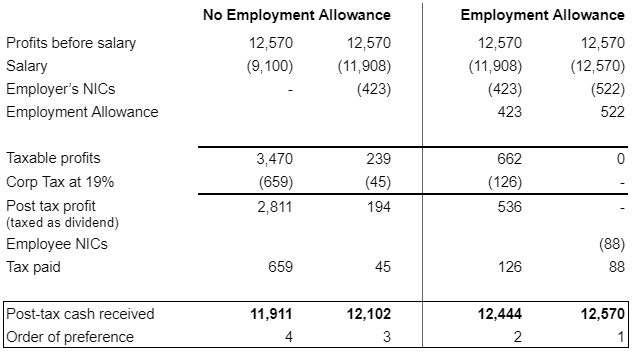

Putting the numbers into practice

Below, we assume profits before salary are equal to the personal allowance for the tax year 2022/23.

Using the £5,000 Employment Allowance

This allowance is not available if you’re the sole director and employee earning above £9,100.

If you are not the sole employee, you may prefer to pay a higher salary to benefit from the Employment Allowance. Whilst the salary would be subject to NICs and Income Tax, the employer’s NICs would be covered by this allowance.

You will only be able to access the allowance if your employer NIC bill is below £100,000 in the prior tax year - this has been the case since April 2020.

Director NICs

Unlike ‘normal’ employees, directors' NICs are calculated based on an annual earnings period - this is to avoid manipulation and mismanagement.

The annual primary threshold for directors for the tax year 2022/23 is £11,908, which works out at £190 per week (6 April 2022 to 5 July 2022) and £242 per week (6 July 2022 to 5 April 2022).

The calculation for directors' NICs can be done in one of two ways - but each will result in the same amount of NICs being payable overall. The main difference between each method is simply timing:

- The ‘standard’ method

NICs are calculated on each salary payment based on the cumulative salary to that date and the annual primary threshold, deducting NICs already paid in the year.

- The ‘alternative’ method

NICs are calculated on each salary payment based on that pay period (weekly / monthly). An annual calculation is then made at the end of each year on total salary payments and the annual threshold - additional NICs may be payable at the end of the year.

Key to note is that because of the primary threshold changes during the year, a salary of £11,908 paid in 12 equal instalments and NICs calculated under the ‘alternative’ method would likely result in NICs being payable in April - June, with a repayment due in month 12 as part of the annual adjustment calculation.

Looking for tax planning support? Look no further!

Get in touch with us today to find out how we can help keep your taxes minimised, and benefit from our expert advice.

Disclaimer

This blog is for information purposes only, and should not be used as a substitute for independent tax advice. Inform Accounting accepts no liability for any loss or damage incurred by you as a result of your acting upon this information without seeking official advice from our payroll and tax advisors.

Read more of Inform's tax blogs:

.jpg?width=1500&height=1000&name=amy-hirschi-K0c8ko3e6AA-unsplash-(5).jpg)