BLOG

THE AUTUMN STATEMENT 2015- TAX

The Chancellor delivered his Autumn Statement on 25 Novemebr 2015, in this blog we have highlighted the key tax announcements.

TAX CREDIT U-TURN

In the Summer Budget the Chancellor proposed cutting the rates and thresholds for working and child tax credits. This would have reduced the income of many low-paid families significantly. The House of Lords blocked the legislation which was to have introduced this change.

The Chancellor has now announced that the rates and thresholds for tax credits will be frozen for 2016/17 at the 2015/16 levels. There is one exception - the disregard of rising income is to be brought in line with the disregard for falling income. Both will be set at £2,500 for 2016/17.

The Government is also proposing to review the rules concerning making single or joint claims for tax credits as this is an area where claimants are easily confused and many mistakes are made.

PROPERTY INVESTORS HIT WITH STAMP DUTY LAND TAX INCREASES

In the Summer Budget the Chancellor announced a restriction on the deductibility of interest from rental income for individual landlords of residential property. This restriction will be phased in from 2017/18 to 2020/21, and it may make letting uneconomic for landlords whose businesses are relatively highly geared. The latest attack on property investors is a proposed 3% increase in Stamp Duty Land Tax.

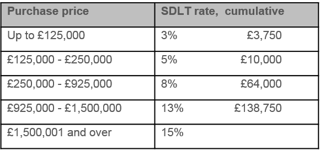

Landlords who can buy properties to let without a mortgage are not affected by the interest restriction. To discourage such cash-rich individuals from purchasing multiple properties to let or to hold as second homes, particularly in holiday areas like Cornwall, an additional SLDT charge of 3% will be payable by individual purchasers of residential properties worth over £40,000 from 1 April 2016. This supplemental SDLT charge won’t be payable by corporate purchasers (15 properties or more) or by funds such as Real Estate Investment Trust (REITS). The proposed rates are:

SDLT is currently payable within 30 days of the completion of the purchase and the SDLT return must be filed within the same period. The Government is proposing to reduce the payment and filing period to just 14 days from the completion date of the sale, sometime in 2017/18.

…AND WILL HAVE TO PAY CGT EARLIER

CGT is normally payable by individuals by 31 January after the end of the tax year in which the gain arose. This gives the taxpayer between 10 and 22 months from receipt of the proceeds to calculate the tax due and pay it over to HMRC. From 6 April 2015 non-resident taxpayers have had a shorter time frame in which to report the sale of UK residential property and pay the tax due - only 30 days from the completion of the disposal. HMRC now propose to extend the 30 day reporting and CGT payment deadline to all UK taxpayers who make taxable gains when selling residential properties for disposals on or after 6 April 2019.

NO CHANGE IN ISA LIMITS FOR 2016/17

The annual limit for savings in an ISA has been frozen at £15,240 for 2016/17. The Junior ISAs limit has been frozen at £4,080.

CAR AND FUEL BENEFIT CHARGES

Diesel company cars currently carry a 3% supplement on the percentage of list price used to calculate the taxable benefit. This diesel supplement was to be removed from 6 April 2016, but it will now stay in place until 2020/21.

Employees and directors with company cars, and who also have some or all of their private fuel paid for by their employers, are subject to the fuel benefit charge - determined by multiplying a notional list price by the appropriate percentage for the car, based on its CO2 emissions. The car fuel notional list price will increase from £22,100 to £22,200 with effect from 6 April 2016. For a company car emitting between 111 to 115g CO2 per km, the scale charge would be 20% of £22,200 and this would result in taxable fuel benefit of £4,440 and £1,776 income tax for a 40% taxpayer. At 11p per mile the employee would need to drive 16,145 private miles to make having private fuel paid for worthwhile.

PRIVATE USE OF COMPANY VANS

Where employees are provided with a company van, the taxable benefit increases from £3,150 to £3,170 for 2016/17 and there will be an additional taxable benefit of £598 where private fuel is provided by their employer.

Note that this charge does not apply to all company van drivers, only those who use the van for private journeys.

COMPANY CAR ADVISORY FUEL RATES

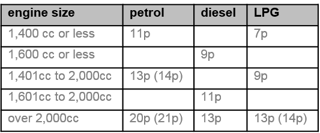

Not part of the Autumn Statement, but you need to know that some of the rates are reduced from 1 December 2015 (previous rates are shown in brackets where there was a change):

NATIONAL INSURANCE RATES FROZEN FOR 2016/17

There will be no increase in the rates of national contributions (NICs) for employers, employees nor the Class 4 rate for the self-employed for 2016/17, although the Upper Earnings Limit for employee contributions and Upper Profits Limit for Class 4 contributions will be increased to £43,000, in line with the higher rate tax threshold.

Employees’ contributions will be payable at 12% on earnings between £155 per week and £827 per week and 13.8% employers contributions will start at £156 per week. The employment allowance increases to £3,000 for 2016/17 and will continue to be deductible from employers’ NIC, although it will no longer be available to one man companies.

BUT LARGER EMPLOYERS WILL PAY A NEW APPRENTICESHIPS LEVY FROM 2017

A new apprenticeship levy will be introduced from 6 April 2017. Although all employers will be required to pay this new levy, set at 0.5% of their annual payroll cost, each employer will also have an annual credit equivalent to £15,000 to set against the levy, which means only the largest employers with payrolls of £3 million or more will actually pay the levy. Based on an average salary, this means that only employers with more than around 100 to 120 employees will be affected. It is not clear at this stage as to what is meant by payroll.

Employers who take on apprentices will receive vouchers funded by the apprenticeship levy to set against the cost of those apprentices.

Inform are here to help you so please contact us if you need further information on any of the topics covered or any other tax related matters.

.jpg?width=1500&height=1000&name=amy-hirschi-K0c8ko3e6AA-unsplash-(5).jpg)