BLOG

Replacing your main residence-getting the SDLT supplement back

Since 1 April 2016, higher rates of stamp duty land tax apply to purchases of second and subsequent residential properties where the cost of the additional property is over £40,000 (i.e. virtually all properties).

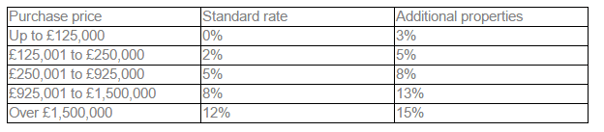

The higher rates are 3% more than the standard rates for residential sales and are as shown in the table below.

Replacing a main residence

The higher rates do not apply to the purchase of a property which is the replacement of a main residence, even if the taxpayer has additional residential properties. However, where the purchase of the new main residence happens before the sale of the old main residence, the higher rates are initially payable on the purchase of the new residence. However, the supplement can be reclaimed provided that the former main residence is disposed of within three years of the acquisition of the new residence.

Example

Julie and John are relocating. As they struggled to sell their existing home and were keen to be in their new home for the start of the new school year, they proceed with the purchase and sale independently. The purchase of their new home completes on 29 July 2016. The sale of the old home completes on 9 September 2016. They pay £450,000 for their new home.

As at the time of the purchase of the new home, they have an additional residential property, they must pay SDLT at the rates for additional residences. The SDLT paid is £26,000 ((£125,000 @ 3%) + (£125,000 @ 5%) + (£200,000 @8%)). This is equivalent to the SDLT at the standard rates of £12,500 ((£125,000 @ 0%) + (£125,000 @ 2%) + (£125,000 @ 5%)) plus a 3% supplement of £13,500 (£450,000 @3%)).

On the sale of their old main residence in September 2016 they can reclaim the supplement. The old residence is sold within the three-year window.

Reclaiming- getting the SDLT supplement back

A repayment of the SDLT supplement can be claimed where the former main residence is sold within three years of the purchase of the new home. The claim form can be found on the GOV.UK website at www.gov.uk/government/publications/stamp-duty-land-tax-apply-for-a-repayment-of-the-higher-rates-for-additional-properties. The following information is required:

- personal details;

- main buyer’s details, if different;

- details of the property that attracted the higher rate of SDLT, including the effective

- date of the purchase and the SDLT Unique Transaction Reference number;

- the amount of SDLT paid on the property that attracted the higher rates; and

- the amount of repayment claimed (i.e. the 3% supplement).

The claim form should be completed online and sent to HMRC at the following address:

HMRC Revenue and Customs – Birmingham Stamp

Please get in touch with us at Inform if you need further advice on getting the SDLT supplement back or for any other tax related matters.

Read more of Inform's tax blogs:

No longer your main residence and final period exemption

What is investor relief? - How can you benefit?

Business and Private use- What can you claim?

.jpg?width=1500&height=1000&name=amy-hirschi-K0c8ko3e6AA-unsplash-(5).jpg)