BLOG

CGT Reliefs

Investors need to have a clear understanding of what tax reliefs are available to them prior to making an investment in shares in a trading company.

There are various CGT reliefs available and the one most suited to an Investor will depend on the individual's circumstances. In summary the reliefs available are:-

- Entrepreneurs' Relief for active directors and employee investors

- EIS or SEIS relief for business "angels", or

- Investors's Relief - for those that do not qualify for any of the above.

The attached summary sets out the key tax reliefs and points which should be considered as a start. However, as with all "matters tax", the devil is in the detail, and before proceeding it is wise to seek full, detailed advice.

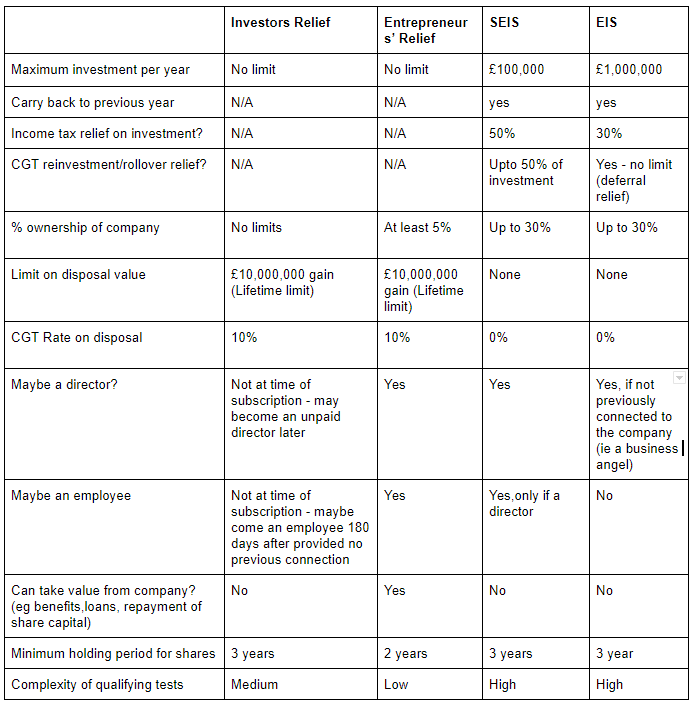

Comparison of Entrepreneurs’ Relief, Investors’ Relief, EIS and SEIS

Below is a summary of key tax reliefs available when investing money in a trading company.

Please note this should be seen as a guide and not detailed tax advice. Specific advice should be sought for each situation.

If you’d like to speak to our experts about CGT reliefs, just give us a call on 0121 667 3882 or email us at hello@informaccounting.co.uk

Read more of Inform's tax blogs:

Choosing the right eCommerce accountant for your business

It's that wonderful time of the year...for fraudsters to pray on taxpayers!

Paying yourself a salary: What are the most tax efficient options for limited company owners?

Four key cashflow issues that could cripple your business (and how to avoid them)...

.jpg?width=1500&height=1000&name=amy-hirschi-K0c8ko3e6AA-unsplash-(5).jpg)