BLOG

Tax-Free Mileage Payments

Many employees use their own vehicles for business journeys. Under the approved mileage allowance payments (AMAP) scheme, employers can make tax-free and hassle-free payments to employees for business journeys, as long as the payment does not exceed the `approved amount’.

What is the approved amount?

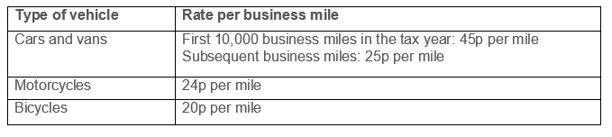

The approved amount is simply the number of business miles that the employee undertakes in his or her own vehicle in the tax year multiplied by the AMAP rate for that type of vehicle for the tax year in question. The AMAP rates are as follows:

Example

Jane uses her own car for business and in 2015/16 drives 12,000 business miles. The approved amount is:

(10,000 miles @ 45p per mile) + (2,000 miles @ 25p per mile) = £5,000.

Jane’s employer can pay her a mileage allowance of up to £5,000 tax-free.

If the amount paid does not exceed the approved amount, the employer does not need to report the mileage payment to HMRC.

Amounts in excess of approved amount

If the amount paid exceeds the approved amount, the excess over the approved amount is taxable. So, if Jane’s employer had paid her 50p per mile, she would have received mileage payments totalling £6,000 in 2015/16 (12,000 miles @ 50p per mile). The £1,000 by which this exceeds the approved amount of £5,000 is taxable and must be returned on Jane’s P11D (in section E).

Mileage relief

If the amount paid is less than the approved amount, the employee can claim tax relief (either on form P87 or via the self-assessment return) for the shortfall. A claim can also be made if the employer does not make mileage payments.

So, if Jane’s employer had paid a mileage rate of 35p per mile, Jane would have received £4,200 in mileage payments in 2015/16 (12,000 miles @ 35p per mile). This is £800 less than the approved amount of £5,000 and Jane can claim tax relief for the £800 shortfall.

Different rules for NIC

A similar system applies for National Insurance purposes. However, the 45p per mile rate for cars and vans applies without limit. Unlike tax, it is not capped at 10,000 business miles per year.

Not for company cars

The AMAP scheme only applies where the employee uses his or her own vehicle. It cannot be used where the employee drives a company car. Separate rates (advisory fuel rates) are used for company car drivers.

If you need further advice on tax-free mileage payments or information on any other tax related matters please get in touch with us at Inform.

Read earlier tax blogs:

.jpg?width=1500&height=1000&name=amy-hirschi-K0c8ko3e6AA-unsplash-(5).jpg)