BLOG PERSONAL TAX COMPANY TAXES, EXPENSES & RATES PAYROLL & PENSIONS NEWS UPDATES GOVERNMENT SUPPORT

Autumn Statement 2023 - Hunt’s 110 measures for growth

Today, the Chancellor of the Exchequer, Jeremy Hunt, announced his measures (a whopping 110 of them) for improving the UK economy, and the lives of UK residents.

In an unexpected move, there was no cut to Inheritance Tax (IHT) as was widely speculated. It appears the Chancellor has listened to his MP colleagues who warned against being seen to give a tax cut to the wealthiest individuals (only around 4% of individuals paid IHT over the £325,000 allowance last year) in the midst of a cost of living crisis.

Despite this, there were a number of welcome measures of increased funding in key sectors and some ‘shock’ tax cuts. We can’t cover all 110 measures in the blog, but here are some of the main measures we think are the most important.

Economic Summary

Inflation

Inflation is forecast to drop to 2.8% by the end of 2024. The OBR and other prominent forecasters have confirmed that they expect inflation will take longer to fall to the target 2%, with the forecasts now not expected to reach this level until 2025.

Growth

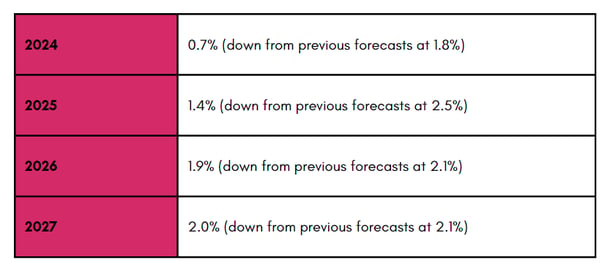

Whilst the economy is expected to grow, the rate of growth has been downgraded, though the new growth rates from the OBR are still more optimistic than the Bank of England.

Income tax and dividends

The rates of Income Tax will remain the same, though the income threshold for the additional rate of 45% has now been reduced from £150,000 to £125,140 for tax year 2023/24, and will continue for tax year 2024/25.

The Dividend Allowance will be reduced further from £1,000 to £500 from the start of the new tax year.

National Insurance

Main Rate (Class 1)

Seen by many as the ‘headline tax cut’ from this statement, the main employee National Insurance rate will be cut by 2 percentage points from 12% to 10% from 6 January 2024. This means someone on an average salary of £35,000 will save over £450 next year.

Hunt stated he would “normally bring in a measure like this for the start of the new tax year in April, but instead, tomorrow I’m introducing urgent legislation to bring it in from 6 January, so that people can see the benefit in their payslips at the start of the new year."

Class 2 and Class 4

Class 2 National Insurance Contributions are to be abolished, saving self-employed individuals £192 per year.

Self-employed individuals paying Class 4 National Insurance at 9% on all earnings between £12,570 and £50,270 will see that rate cut by 1 percentage point to 8%.

Together, these cuts are expected to save the average self-employed individual £350 per year from April 2024.

National Living Wage (NLW)

The NLW will increase from £10.42 to £11.44 per hour (a rise of 9.8%) from April 2024. The higher wage will also be paid to 21 and 22-year olds for the first time (currently only individuals over 23 years old receive £10.42).

The Chancellor also confirmed that 18 to 20-year-olds will receive a £1.11 hourly rise to £8.60, whilst 16 to 17 year olds will receive a £1.12 hourly rise to £6.40 (this increase also applies to the apprentice wage, bring this to £6.40).

Benefits (Universal Credit)

From April 2024, Universal Credit will increase by 6.7% in line with the inflation figure at September 2023, increasing the income for those on benefits by an average £470 per year. This is a welcomed increase, as it was rumoured the lower inflation figure of 4.6% from October 2023 may have been used instead.

But this increase doesn’t come without a cost, as the Chancellor leads a crackdown on benefits users. If an individual on benefits, after seeking work for 18 months, has failed to find employment, they will have to take part in a mandatory work placement “to increase their skills and improve their employability”. Failing to engage with the work search for 6 months will result in a termination of their benefits entitlement.

Pensions

Hunt has committed to the pension triple lock “in full”, with an increase of 8.5% to £221.20 per week to the full new state pension (worth up to an additional £900 each year) from April 2024.

The Lifetime Allowance (LTA) ceiling of £1,073,100 is also set to be abolished from April 2024.

Individual Savings Accounts (ISAs)

ISA limits will be frozen, though having multiple ISA accounts of the same type will be permissible, as well as partial transfers of ISA funds.

Apprenticeships

£50m of funding over the next two years will be committed to help grow the number of apprentices in engineering and “other key growth sectors”.

Capital Gains Tax (CGT)

The CGT annual exempt amount, currently at £6,000 per year, will be reduced do £3,000 per year from April 2024.

‘Full expensing’ made permanent

A welcome measure for businesses that heavily invest, ‘full expensing’ for businesses, previously due to expire in 2026, has been made permanent. This means that for every £1 that a business invests in IT, machinery and equipment, they can claim back 25p in corporation tax.

Research and Development (R&D)

Existing R&D schemes - the Research and Development Expenditure Credit (RDEC) and SME scheme, will be merged, affecting expenditure incurred in accounting periods beginning on or after 1 April 2024.

The notional tax rate applied to loss-makers in the merged scheme will be reduced from 25% (the main rate currently set in the RDEC) to 19% (the small profit rate).

Business Rates

Hunt has confirmed the way in which business rates are currently calculated has been frozen for an extra year, and maintains the existing 75% discount on rates up to £110,000 for retail, hospitality and leisure businesses. These measures are expected to save the average independent shop over £20,000, and the average pub over £12,800 over the next year.

Rent

The Local Housing Allowance rate will increase to the 30th percentile of local market rents, giving 1.6 million households an average £800 support in 2024.

Duties

Roll-up tobacco duty will increase by an additional 10% above the tobacco duty escalator, whilst duty on ALL alcohol is frozen until 1 August 2024.

Artificial Intelligence

The government will invest £500m over the next two years to fund more ‘innovation centres’ to help make the UK an “AI powerhouse”.

‘Strategic Manufacturing’

The Chancellor announced an additional £4.5bn of support between 2025 - 2030 for "strategic manufacturing" businesses, including £975m for aerospace firms, £520m for life sciences like medical research companies, and £960m for the new green industry firms.

Tackling anti semitism

In light of a rise of antisemitism in the UK following the Hamas attack on Israel, and the ensuing war in Gaza, the government has committed to spend up to £7m over the next three years on organisations such as the Holocaust Education Trust, to help tackle anti semitism in schools and universities.

What do you need to do now?

Given the extra costs and investment incentives the government has introduced for small business, we strongly recommend doing some planning.

-

Put together your business plan for 2024 and model the impact of rising costs. Do you need to:

-

Increase your prices?

-

Reduce your overheads?

-

Increase your wages?

-

-

Consider the investment incentives, such as full expensing, that have been introduced or retained.

-

Have you put off spending plans because of the previous deadline of 2026 that you could now pull forward?

-

Do you now have opportunities to invest in your IT infrastructure, machinery and equipment?

-

-

Who in your staff needs a pay rise to avoid falling foul of the rise in National Minimum Wage?

As always, we’re here to help - just give us a call on (0121) 667 3882 if you need help with any of these next steps.

.jpg?width=1500&height=1000&name=amy-hirschi-K0c8ko3e6AA-unsplash-(5).jpg)