BLOG

Claim fixed rate deductions to save work

To make life simpler and remove the need to keep detailed records of actual expenses, businesses can claim a fixed rate deduction in respect of certain expenses. The option to claim a fixed rate is available for motor expenses and for additional household expenses where the home is used for business purposes.

Motor vehicles

Businesses can claim a fixed rate per business mile deduction for the vehicle expenses. The fixed rate deduction covers the cost of buying, running and maintaining the vehicle (including the cost of fuel, oil, servicing, repairs, insurance, VED and MOT). The use of fixed rates is optional and is open to sole traders and partnerships, as long as they do not have a corporate partner.

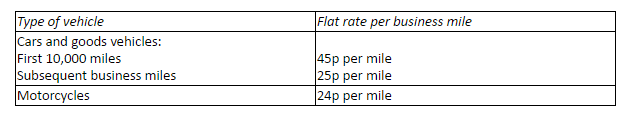

The fixed rates per mile are as follows:

Once a business elects to use the flat rates, they must continue to do so whilst the vehicle remains in the business. Capital allowances cannot be claimed where the simplified rates are used and if capital allowances have been claimed in respect of the vehicle in question, it is not possible to use the flat rates.

Use of home

It is also possible to claim a fixed rate deduction for the use of home for the purposes of the business. The flat rate provides an allowance for additional household running expenses incurred as a result and covers the additional costs of cleaning, heat, light, power, telephone, broadband etc.

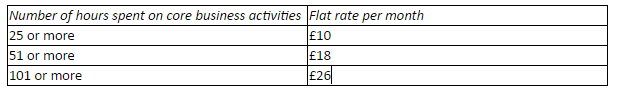

The deduction is based on the total number of business hours spent working in the home on core business activities in the month and is as follows:

Core business activities are providing goods or services, maintaining business records and marketing and obtaining new business.

Example

Louise is a nail technician. She provides a mobile service and also works from home. In 2015/16 she spent 60 hours a month working in her home on core business activities and she drove 15,000 business miles.

To save work, she claims flat rate deductions in respect of the use of her car and business use of her home.

For the car she claims a deduction of £5,750, being 10,000 miles at 45p per mile (£4,500) plus 5,000 miles at 25p per mile (£1,250).For use of her home she claims a deduction of £18 per month – an annual deduction of £216.

Need to know: Claiming fixed rate deductions removes the need to keep records of actual costs.

Please get in touch with us at Inform if you need further advice on how to claim fixed rate deductions or for any other tax related matters.

Read more of Inform's tax blogs:

Common expenses that you can set against your rental income

.jpg?width=1500&height=1000&name=amy-hirschi-K0c8ko3e6AA-unsplash-(5).jpg)