If you are a sole trader or landlord, the way you handle your taxes is changing right now. With the...

News & Insights

Read the latest insights from our experts

Explore more

In her tax-raising Budget on 26 November 2025, the Chancellor announced that the dividend ordinary...

During the Chancellor’s Budget speech, savers received the unwelcome news that the rate of tax on...

8 Jan 2026

Are you exempt from MTD for ITSA?

Making Tax Digital for Income Tax Self Assessment (MTD for ITSA) is mandatory from 6 April 2026 for...

25 Nov 2025

Do you have an unclaimed Child Trust Fund?

A press release recently published by HMRC revealed that 758,000 young people between the ages of...

The normal filing deadline for the 2024/25 Self Assessment tax return is 31 January 2026. However,...

17 Nov 2025

What counts as a ‘reasonable excuse’?

A taxpayer may have grounds for appealing a penalty if they have a reasonable excuse for missing a...

22 Sep 2025

Taxation of savings income in 2025/26

There are various ways to enjoy savings income without paying tax on it. In addition to the...

Making Tax Digital for Income Tax Self Assessment (MTD for ITSA) is introduced progressively from 6...

7 Aug 2025

Extension to MTD for ITSA

Making Tax Digital for Income Tax Self Assessment (MTD for ITSA) is introduced progressively from 6...

10 benefits of filing your 2024/25 tax return early As the 2024/25 tax year has now come to an end,...

Tax deadlines, whether for self-assessment, VAT, PAYE, or Corporation Tax, can create significant...

1 Jul 2025

Payments on Account - due soon!

The deadline by which to pay your second payment on account for your self assessment tax return is...

18 Jun 2025

Claiming mileage relief

Employees may pay for the fuel that they use for business journeys undertaken in their own car or...

24 Apr 2025

Claim a refund if you have overpaid tax

There are various reasons why tax may be overpaid, and when more tax has been paid than is due, it...

17 Apr 2025

Starting a business as a sole trader

When starting a business, there are various decisions to make and tasks to perform. One of the...

For many years the most tax-efficient method of withdrawing monies from a company by a sole...

Benefits in kind (BIK) are goods and services provided to an employee (or a member of their family...

If you are self-employed, you will pay tax on your taxable profit. In working out your taxable...

High Income Child Benefit Charge Income thresholds for the High Income Child Benefit Charge (HICBC)...

12 Feb 2025

Is it worth paying voluntary Class 3 NICs?

The payment of National Insurance contributions is linked to entitlement to the state pension. If...

If you are self-employed, you will pay tax on your taxable profit. In working out your taxable...

1 Nov 2024

Budget to increase taxes by £40bn

After a damning verdict on the inheritance of the public finances from the previous conservative...

24 Jun 2024

Understanding your tax code

Tax codes are fundamental to the operation of PAYE. If your tax code is correct, you should pay the...

29 May 2024

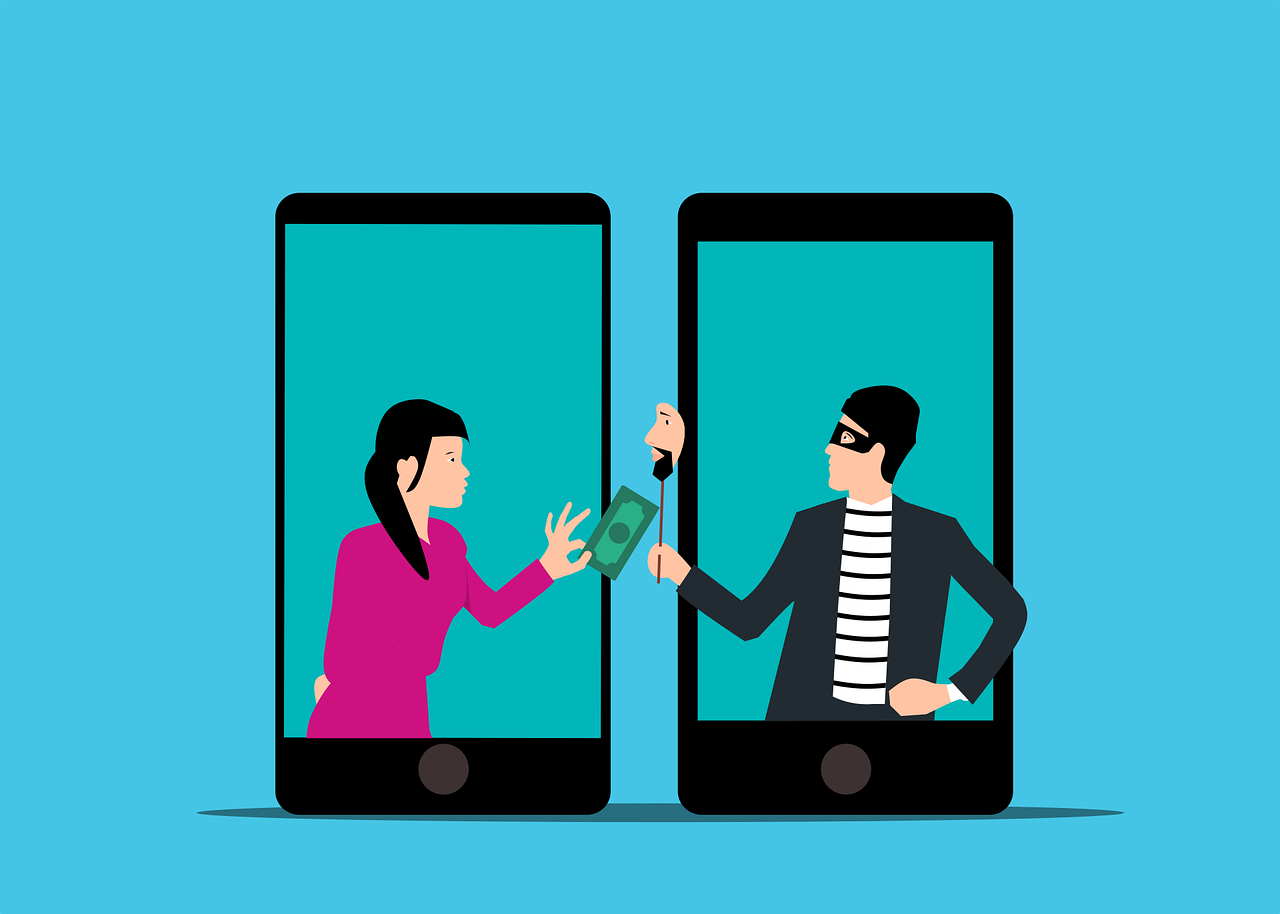

Navigating HMRC Scam Letters: How to Spot a Fake

In today's digital world, fraudulent schemes - particularly those involving HMRC scams - are on the...

It is often said that inheritance tax (IHT) is a voluntary tax, and one that can be avoided if you...

30 Apr 2024

Check your National Insurance record

Paying National Insurance contributions allows individuals to earn qualifying years, which in turn...

HMRC are sending one-to-many ‘nudge’ letters to taxpayers who included an invalid claim for gift...

27 Feb 2024

Year End Tax Planning Guide

With the closure of the 2023 tax year approaching on April 5, 2024, there remains an opportunity to...

The High-Income Child Benefit Charge (HICBC) is a tax charge that claws back child benefit where...

Main residence relief is a valuable relief which prevents a tax charge arising where a gain is...

28 Nov 2023

Reporting residential property gains

If you make a chargeable gain on the sale of a UK residential property, you will need to report the...

Today, the Chancellor of the Exchequer, Jeremy Hunt, announced his measures (a whopping 110 of...

31 Oct 2023

Self-serve Time to Pay for VAT

For some time, taxpayers within Self Assessment have been able to set up a Time to Pay arrangement...

26 Oct 2023

Claiming overlap relief

If you are self-employed, the way in which your profits are taxed is changing. As a result of this,...

Private residence relief means that you do not have to pay capital gains tax on any gain that you...

13 Oct 2023

Should I file my tax return early?

If you need to file a Self Assessment tax return for 2022/23, you have until midnight on 31 January...

3 Oct 2023

How to appeal a tax penalty

There are various reasons why HMRC may issue a tax penalty. You may receive a penalty if you file...

29 Sep 2023

Autumn Statement date set for 22 November

The Treasury has announced that the Office of Budget Responsibility (OBR) will produce a report on...

15 Aug 2023

Unincorporated businesses overlap relief

From 6 April 2024, all unincorporated businesses will be taxed on their profit or loss arising in...

19 Apr 2023

Managing inheritance tax

Like many other taxes, inheritance tax (or IHT) allowances have been frozen. This sounds generous...

21 Mar 2023

Tax Rates & Reliefs

On 15 March 2023, Chancellor Jeremy Hunt presented his first Budget to Parliament and set out a...

If you are planning to claim the UK state pension you should check your national insurance (NI)...

The mandatory use of software for Making Tax Digital for Income Tax Self-Assessment is being phased...

HMRC is reminding taxpayers that they must declare COVID-19 payments in their tax return for the...

28 Nov 2022

“Off-payroll” working rules continue to apply

With all of the U-turns on tax policy in the last couple of months, businesses may be confused...

14 Nov 2022

Own a Buy to Let? Then read on...

If you own a property which is let out, HMRC may contact you with a "nudge letter'', if they...

We all have to pay taxes. But what if we told you there are several strategies you can adopt to...

If you own property there are a number of tax implications which you need to be aware of.

Class 2 NICs are flat-rate contributions payable by the self-employed, currently charged at a rate...

Tax payments for the self-employed or those who declare their income under self-assessment are...

If you have a spare room in your home, you may consider letting it out to raise some much-needed...

28 Jun 2022

Giving away money free of IHT

Most people do not want to give money to the taxman when they die. However, while it is said that...

Claims for the fourth Self Employed Income Support Scheme (SEISS) can now be made and must be...

It’s a great place to work

At Inform Accounting, what we do is about so much more than making money and helping our clients manage theirs.

.jpg)