BLOG APPS & PARTNERS

Funding support from Funding Circle

We’re proud to partner with Funding Circle to provide a funding solution for our clients. We know that the reasons for funding are varied, and therefore one funding solution does fit all.

In this blog, we take a look at the different finance options available, conditions and some top tips to ensure a successful application!

The Application Process

-

One of our team will be in touch to discuss your request and to gather any extra information we need to start the funding application with our partners.

-

You’ll receive a link from one of our funding partners to complete. The online application takes around 10 minutes to complete.

-

Instant decision technology means that for applications under £100k, you could receive an offer in as little as 10 minutes! If your application is greater than £100k, documents will be requested.

-

Funding Circle’s new ‘soft search’ allows businesses to get a credit backed offer with no credit footprint (pretty snazzy).

-

-

If your application is successful, you’ll receive an offer (or multiple if you’re lucky) to accept.

-

Once you’ve accepted the offer, the funds will be transferred to your chosen bank account within 48 hours.

CHOOSE YOUR FINANCE

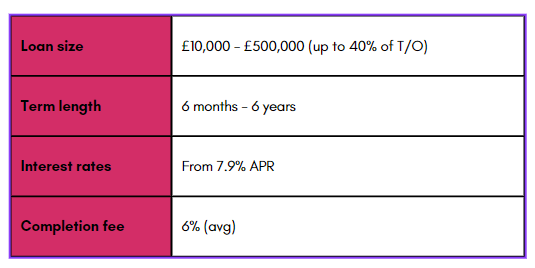

Traditional Loans

Requirements to secure funding:

-

1 year of trading

-

Filed accounts and UK business bank account

-

Strong credit files

-

For all shareholders over 25% you will need to provided their name, DOB and address

-

Personal guarantee

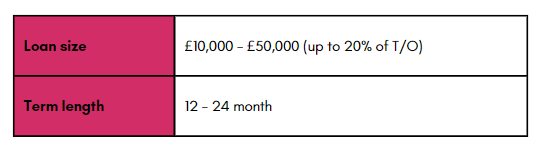

Short-term Loans

Don’t meet the above conditions? Funding Circle now offer enhanced short-term lending which has expanded how many businesses they can say yes to! The aim is to support younger, less established businesses with funding.

Requirements to secure funding:

-

1 year of trading

-

Weaker credit businesses

-

Non-homeownership (100k max cap)

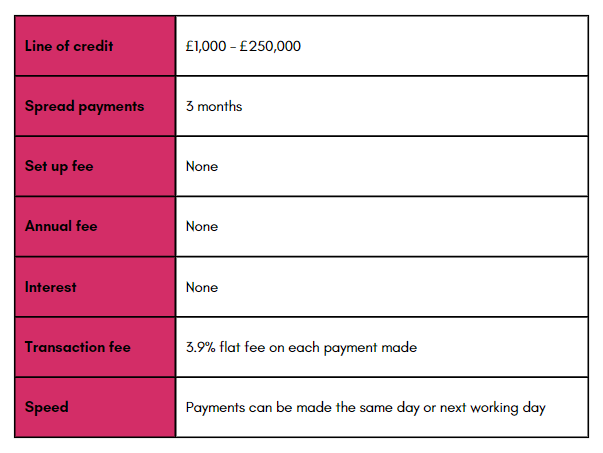

FlexiPay

FlexiPay is a line of credit product, designed to help businesses better manage cash flow.

Check out this short video to see how FlexiPay works:

What businesses are using FlexiPay for:

-

Pay VAT, energy or other business bills

-

Bulk buy or negotiate better terms with suppliers

-

Purchase stock or equipment

-

Spread quarterly costs out monthly

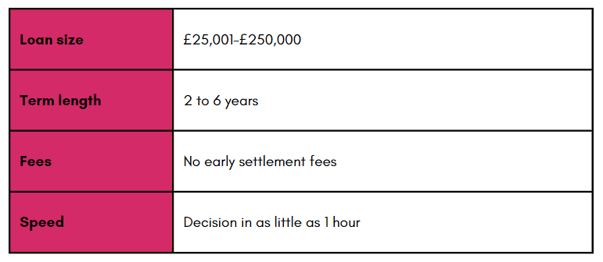

Government-backed Recovery Loan Scheme (RLS)

The new iteration of the Recovery Loan Scheme (RLS) launched in August 2022 and is designed to support access to finance for UK small businesses as they look to invest and grow.

The Recovery Loan Scheme aims to improve the terms on offer to borrowers. If Funding Circle can offer a business loan on better terms, they will do so.

Eligibility requirements:

-

Have a turnover of up to £45 million

-

Be trading in the UK for a minimum of 2 years

-

Be a limited company

-

Use the loan for business purposes such as working capital or investment

-

Not be in difficulty or have any collective insolvency proceedings ongoing

The scheme comes with a 70% Government guarantee. However, this guarantee is to the lender and the borrower always remains 100% liable for the debt.

Marketplace

Marketplace is Funding Circle dedicated team of account managers, working with a panel of partner lenders, to provide a ‘whole of market’ offering.

-

The Marketplace team assess unsuccessful applications and, if eligible, applicants will be contacted within a 48 hour period to provide alternative options.

-

Funding Circle work with a number of lenders, such as Nucleus Finance and White Oak alongside others, to offer additional product classifications.

Asset Finance

Asset Finance is the newest offering from Funding Circle, helping to assist with both ‘hard’ and ‘soft’ assets, with the most common funding requests being for vehicles, machinery and production equipment.

A recent case saw an application request for vehicle finance from a client assessed, offered and completed within 48 hours!

Its relationship with its Asset Finance lenders, enables them to provide swift results for our customers.

Top tips for a successful application:

-

At least one director and 50% of shareholding must be in place for at least 12 months.

-

Customers may need to provide 6 months of business bank statements in PDF format and full filed accounts.

-

For applications above £100k, UK homeownership is required.

-

Applications are possible for businesses based in Northern Ireland, but not the Republic.

-

Shareholders on the application must be UK residents with indefinite leave to remain (ILR).

-

All loans by Funding Circle require a signed personal guarantee from at least 50% of shareholding.

-

You will need to provide an in date ID and proof of address for anyone listed on the application.

Transparency statement

Inform Accounting receives commission on each successful funding application referred to partners through us.

.jpg?width=1500&height=1000&name=amy-hirschi-K0c8ko3e6AA-unsplash-(5).jpg)