Supporting you with all things Making Tax Digital

.png?width=173&height=111&name=xero-tax-specialist-badge%20(1).png)

Making Tax Digital (MTD) is an initiative from HMRC, aimed at making the UK’s tax system one of the most advanced digital tax administrations in the world.

MTD is designed to make it easier for both businesses and individuals to pay the right tax and to gain better visibility of what they owe throughout the year.

It means that whether you’re a one-man-band or a corporate giant, your business is required to maintain digital records and submit your information to HMRC using compatible software such as Xero, Quickbooks and FreeAgent.

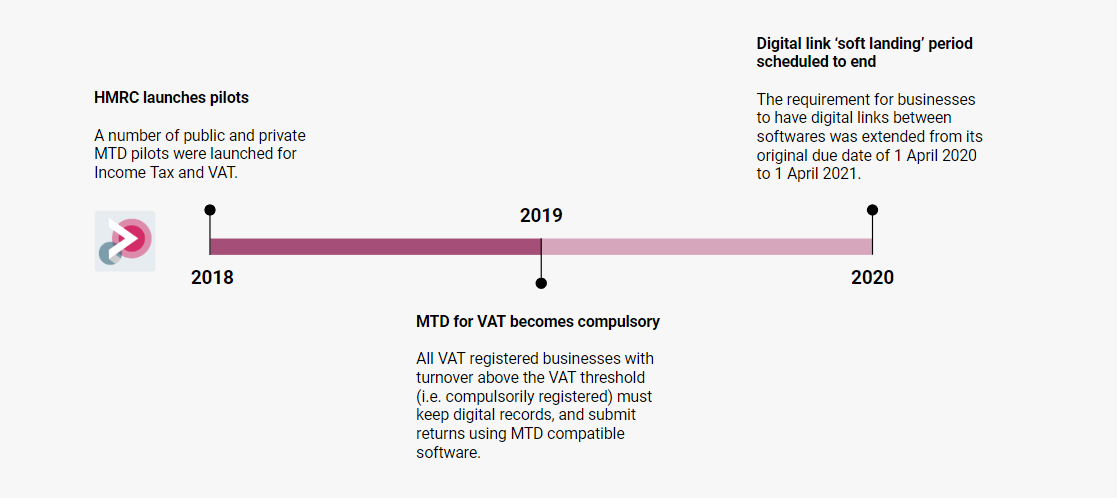

The first wave of MTD was introduced for VAT in April 2019, with the next phase for Income Tax (MTD for IT) due for implementation for many individuals from April 2026.

You may have already been impacted by changes if your business is VAT registered, but if you haven’t yet come across MTD and submit an annual self assessment tax return, you will soon be impacted by MTD for IT.

Whether you’re already on software, or still maintain manual records, it’s time to start thinking about how you may be impacted by the next wave of MTD.

If you’re already using software to maintain your records, then that’s great! But will the software platform you’re currently using support the MTD requirements for Income Tax as well?

There are at least 20 platforms currently developing solutions for MTD for IT, with Xero among one of the first to be approved.

Even if you’re already on software like Sage to manage your accounts, we can provide a simple migration to Xero through our Xero Implementation Programme.

Whether you’re concerned with MTD for VAT or Income Tax, if you’re still managing your accounts and preparing returns in Excel, or even using the ‘old faithful’ pen and paper, Making Tax Digital requires your process to a more modern system.

As well as helping you fulfil your Making Tax Digital obligations, software like Xero, Quickbooks and FreeAgent bring a whole host of benefits that help you build your business - and thanks to our years of experience in working with these platforms, we can help get you set up with the minimum of fuss.

.jpg?width=1200&height=800&name=christina-wocintechchat-com-YCrgxs3e9lY-unsplash-(1).jpg)

Need help setting and achieving your goals? The KPIs listed in this guide will help provide the insight you need to keep your business growing. We can help you set your targets, track your data and report back through the provision of management accounts - a monthly or quarterly set of statements that put you firmly in control of your finances.

At Inform Accounting, what we do is about so much more than making money and helping our clients manage theirs.